Although the Toronto Stock Exchange approval to launch the stock box on the Stock Exchange for 3iq has not led – directly – at the high price of Bitcoin, but this stage is a victory for the entire digital asset sector; Ripple Labs supported the fund and launch without administrative expenses, which makes it available for a wider segment of small investors and investment establishments.

The Ripple-XRP is the main beneficiary of the publication of the fund, but this organizational achievement indicates the expansion of the growing acceptance of the Crapto Crapto for the furthest of Bitcoin and Ethereum-Eth. With more alternative currency funds entering the market, Bitcoin should benefit from increased confidence in investments and infrastructure development.

Another ETF XRP was abandoned in Canada!

Crypto asset manager 3iq has just launched a #Xrp ETF, under the XRPQ Ticker, on the Toronto Stock Exchange.#Ripple Is back

XRP receives institutional treatment.pic.twitter.com/iiuck8vdz18

– Office area (@coinbureu) June 18, 2025

The presence of the ETFS place is the most complete sign of the maturity of this category of assets, and the door opens with a lasting additional investment in Bitcoin.

- 3iq launches the XRP box on the Stock Exchange (XRPQ), which is supported by Ribel.

- There are no administrative costs in the first 6 months.

- The fund provides cold storage (without internet connection) to various assets, subject to regulatory laws and easy access to investors around the world.

A breakthrough for a $ 90 million platform raises security and political concerns

NOBITEX – A main trading platform for digital currencies in Iran – has been subject to a cyber attack with political reasons which caused losses of more than $ 90 million, because the predatory group supported Israel, gaps for arrival of internal security and used the names of a portfolio with political connections to burn digital active 2 million dollars of bitcoin and more than $ 49 million in Tron-TRX.

“ Pro-Wesrael Hacker Group ‘, burns $ 90 million Bitcoin Iranian Iranian Bitcoin

►– Decrypt (@DecryptMedia) June 18, 2025

Although the origins of cold storage portfolios are always safe and the Nobitex platform is committed to compensating for people affected, this incident highlights the fragility of the safety factors linked to digital currencies in sensitive geopolitical areas, but that has not affected the bitcoin market, which suggests the creation of investment institutions in this currency.

- Burns of digital assets which included Bitcoin and you see $ 90 million.

- Articulates the Noitex services and undertook to compensate for the affected people.

- Increased safety problems, but the Bitcoin currency market is still stable.

Prenetic barit on bitcoin indicates the expansion of institutional investment

In an evolution that strengthens the long -term positive prospects for Bitcoin currency, the company, specializing in health care based in Hong Kong, has invested in Bitcoin currency, it bought more than 187 BTC currency at an average price of $ 106,712 per coil, and the company used the Cripto Strategic Consultant associated with the management of Trump Hoyos Lopz and CEO of Okex and the efforts to engage more in the world of Cripto.

Just inside:

The Pennetics health care company buys $ 20 million BTC and adopts #Bitcoin Treasury strategy. pic.twitter.com/sdfweo7ev7

– Bitcoin Magazine (@bitcoinmagazine) June 18, 2025

The precency maintains cash reserves equal to $ 117 million and plan to increase its Bitcoin balance, which reflects the acceleration of its adoption outside of traditional financial departments, and this step – which is in accordance with political trends supporting Bitcoin – can help accelerate the pace of the management of companies and governments to the Bitcoin Strategic Assembly.

- Buy 187 BTC Currency at an average price of $ 106,712

- The company’s share price increased by 8.7% after the announcement

- Appointment of consultants linked to the Trump administration and the Okex platform

Technical analysis of the price of bitcoin: the approach of the end of the triangular style makes the price pay for a pivotal decision zone

Bitcoin is currently negotiating nearly $ 104,773, where its price continues to approach the point of the upper steering line and the average Mubulation line – which is the descending and stable track at $ 105,529 – for 50 negotiation candles, and the last three commercial candles have shown clear defense attempts in terms of support of $ 104,000.

The MacD index witnesses a rapprochement that suggests the occurrence of a rising intersection.

- A positive catalyst: Top 105 530 fence

- A descending catalyst: Stability is less than $ 103,500

- Momentum: Trading sizes and MacD index must be monitored

Currently, the expectations of the Bitcoin prices remain cautious in the midst of different stimuli, because the merchants expect from the confirmation of the management before making their decision.

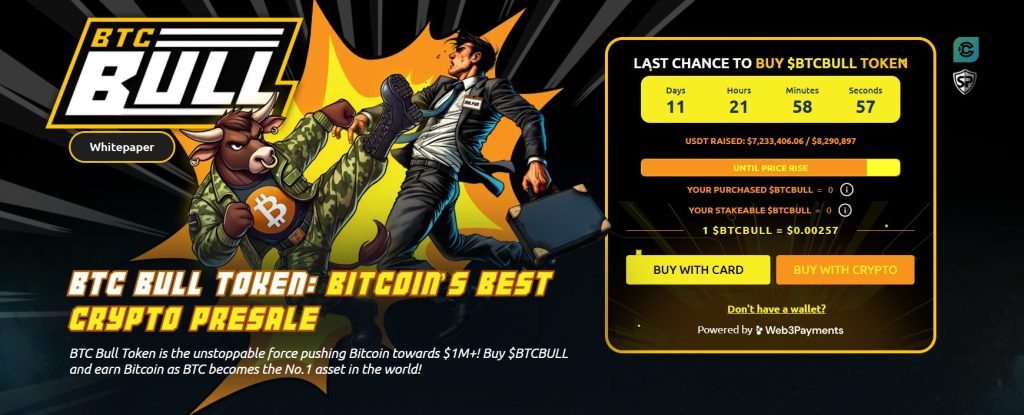

Bitco Bull is close to its target of $ 8.2 million thanks to annual mortgage income of 56%

With the stability of Bitcoin exchanging around $ 105,000, the concentration of investors is transformed into alternative currencies, the most important of which is currently Bitco Bull-Btcbul, which has managed to receive funding of $ 7,246,372 out of 8,290,897 $, so that almost a million dollars should be performed before the price increase. Following. Then we will see an increase in the price compared to the current price of $ 0.00257.

Bitcoin Bull connects its value directly at the start of Bitcoin with two mechanisms:

- Distribution of Bitcoin free sales to reward its owners, while giving priority to subscription investors.

- A gradual burn of the BTCBull offer whenever the price of Bitcoin increases by $ 50,000, which contributes to reducing its rolling diet.

The mortgage complex also provides enriching annual mortgage bonuses (APY), which currently represent 56%, knowing that 1,876,660,951 currencies have so far mortgaged; It also provides a unique mortgage mechanism, the most important of which are:

- The absence of reservation or expenses.

- Provides liquidity if necessary.

- Even stable mortgage yields even with extreme fluctuations on the market.

All this makes this mortgage mechanism a temptation for professionals of decentralized financing systems (DEFI) and beginners who wish to earn income without making an effort. With 11 days remaining the target result of the current step and the price increases after its completion, the demand for Bitcoin Bull, which combines the association of its value at the price of bitcoin and the mechanisms for reducing supply and the flexible mortgage, with the drop in its purchase at its current price before the next increase.

The Bitcoin-BTC position is under pressure: a security violation of $ 90 million, an institutional purchase of $ 20 million, and support appears again first on Arab Cryptonews.