The Santiment platform has warned that the growing conversation of the reduction in the federal interest rate reserve could negatively affect digital assets, noting that the general mood of the community has now reached the peak of its optimism in the 11 months, which can mean that the market is at the highest level of the short-term level before facing a temporary correction.

Optimism has dominated the possibility of federal reserves to reduce interest rates – and its expected impact on stimulation of the start of digital currencies – the general mood of investors recently, but the Santiment platform specializes in the analysis of blockchain data warned that the purchase mentality based on rumors and sale from investors.

And in another “An analytical report for the Cripto markets for this week”Brian, one of the platform analysts, stressed that the crapeto markets showed clear forces.

The general mood of the community towards the reduction of interest rate reduction in interest rates is a warning bell

After the statements of Jerome Powell-Jerome Powell, the Jackson Hole Federal Reserve Head, in which he referred to the possibility of reducing interest rates, Ethereum-Eth drew attention to his solid performances and exported by a digital high rate of money, where analyst Brian stressed the start of what can be the highest.

This occurs while the price of Bitcoin-BTC continues to decrease to around $ 111,460 after having failed to penetrate the barrier of $ 120,000, and the data of the health platform linked to the general mood of the community indicates the need to be cautious, in particular after having reached the level of discussions linked to terms such as the level of federal reference and the “interest rate” and “reduced” Platform platforms is its reserve level for 11 months.

It should be noted that historical data show that the sharp increase in discussions on one of the promising developments often reflect excessive levels of optimism, and it can represent an indication of warning that the market can approach the highest levels of this stage, especially since the analyst has underlined a distinctive general mood indicator which monitors the movements between comments.

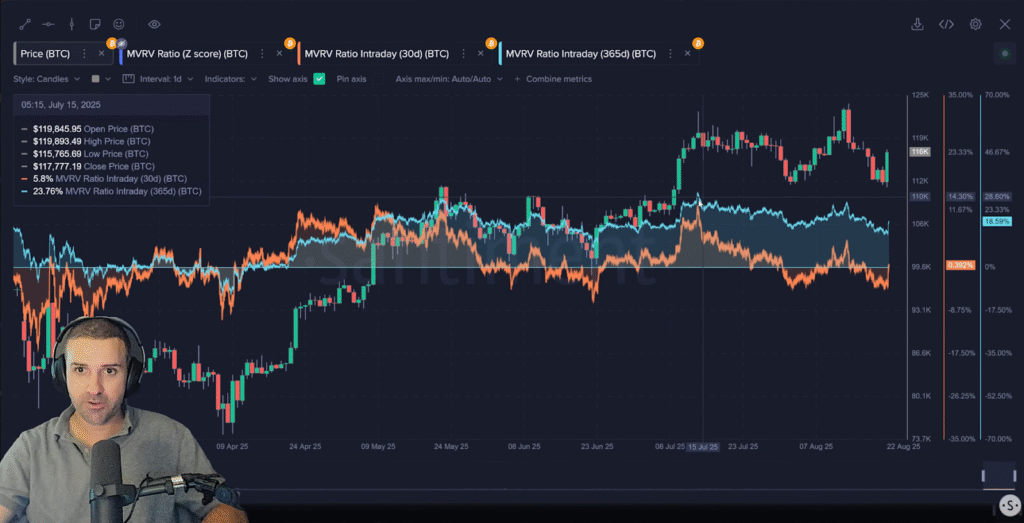

On the other hand, Bitcoin Bitcoin measures show a balanced future vision to be careful; The indicators of actual use – including daily active securities and transaction sizes – have shown a drop in relation to their previous levels, and the long -term market value rate compared to the value obtained – (MVRV), which measures the extent of the owners of current currencies – is currently 18.5%, which places new long -term transactions in a moderate risk.

Funding rates (the value of pious term offers) also show the part Bitcoin (bitcoin) that traders are increasingly betting on high value, but one of the most anxious developments in blockchain – highlighted by the analysis of the Santiment platform – is the increase in supply available on negotiation platforms.

Since the beginning of June, Bitcoin Bitcoin sales have increased on platforms of around 70,000 currencies, a notable change compared to the continuous model of asset transfer to cold storage (not connected to the Internet), which may indicate that more currency owners are preparing to liquidate their centers.

Ethereum’s performance seems to be a missionary, but it is not without risks

Ethereum prices seem encouraging, but its MVRV standards indicate the need to pay attention; The short distribution MVRV rate (30 days) exceeds the threshold of 15%, which is known as “danger zone”, because alternative currencies often testify to waves of decline when they reach this percentage, but the most anxious is a long -term MVRV reading which exceeds 58.5%, which considerably increases the possibility of the owners of currencies.

As part of his closing tickets, Brian explained that the price of Ethereum is still with strong horizons to exceed its highest levels recorded and test the barrier of $ 5,000, especially since the wave of fear of missing the risk of winning (FOO) has not yet reached its extent, but the speech of the federal reserve remains the main threat of market stability; If developments appear unlike expectations of reducing interest rates, we can attend a strong wave of correction.

Technical analysis: Bitcoin is the risk of correction at $ 104,000

The graphic plan for daily Bitcoin currency rates reveals a clear weakness after its inability to restore the critical resistance barrier of $ 120,000, especially since it broke its growing steering line to confirm the change of momentum. In his latest attempts, the price did not enter the scope of the previous support either which turned into a resistance barrier, after which he would withdraw to his current level.

With an examination of the Fibonacci correction levels, the price is exposed to the pressure around the level of 0.382 of $ 114,55, so that the expected decline wave will become $ 10,200 and perhaps 10,3800 if the pressure pressure intensified, in particular because the attempted test failed and the breaking of the line of rise in the suggestions of the possibility of a deeper correction in the term for the term 10,80,000 deeper -104,000, unless buyers can decisively restore a barrier of $ 120,000.

Etheremm

The price of Ethereum is currently in the chain style on the graph for four hours after an upward rise, because the currency is currently negotiated at $ 4,551, a decrease of 4.16% within 24 hours, which makes it close to the previous support at $ 4,600, and its technical position indicates an imminent redemption due to the area of a positive yield to open speculation agreements. At a high price.

Finally, the RSI index appears at 45, which reflects a relatively neutral condition with a soft mile to sell, and leaves room for a higher momentum if the price can restore the level of support. If the price has $ 4,600, it is likely to start testing the nearest resistance barrier at $ 5,006 and $ 5,210.

The hunting of the position warns that the growing conversation of interest rates reduction can negatively affect digital assets appeared first on Arab Cryptonews.