Bitcoin officially recorded a new record at $ 111,999, transcending its recently recorded level in May 2025; In a case where many analysts plan to mark the launch of a new emerging market for digital currencies, with the support of growing institutional interest and the restoration of individual investors their purchasing activity.

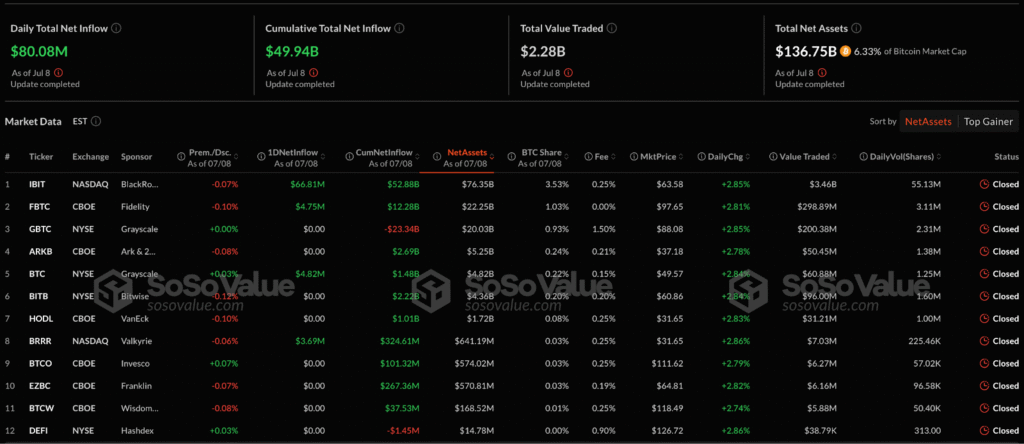

In recent weeks, the institutional interest in Crapto assets has increased according to the reports of the Coinshares website, as well as immediate negotiation funds for Bitcoin Spot ETF in US scholarships and net daily investments of 80.08 million dollars until July 8, to reach total net investments have received $ 49.94 billion and the total value subject to These funds 13655 6.33% of the market value of Bitcoin, according to Sosovalue.

Source: Sosovalue

This Rise Coincided With An Unprecededented Weakness of the US Dollar Currency (USD), as Evidence of the Decline in the Dollar Dxy Index at a Rate of 10.1% Compared to its level at the Beginning of the Year in Its Worst Package 1973, Wher President Donald Trump’s Interest Rates by 300 Basis Points (3%) – 3 Times the Large Reduction in History – To the Emergence of Additional Pressure On The Dollar the American, and Pushed Investment Institutions Towards Bitcoin as a hedge tool.

First, President Trump Monsins that high prices cost the American money on interest.

At a high level, it’s true.

Annual interest expects the American debt reacted to $ 1.2 million in the past 12 months.

The United States now pays $ 3.3 billion in interest per day. pic.twitter.com/2n9m2pdfx– The letter Kobeissi (@kobeissileter) July 9, 2025

It should be noted that the weakness of the US dollar provides a favorable atmosphere for the prosperity of risk assets, with a drop in total agreements of speculative asset management funds, because the price of the dollar has decreased at its lowest levels in the middle of -2021.

On the other hand, the dollar index (Dxy) has decreased by around 6.5 points compared to the average intermediate index of 200 days (DMA-200), which is the biggest difference in 21 years, providing unprecedented favorable conditions for Bitcoin and other alternative assets.

The low American dollar provides the most appropriate atmosphere for the launch of the price of Bitcoin currency (Bitcoin)

According to the complete analysis published by Kobeissi’s letter, the American president’s proposal to reduce interest rates can lead to 300 base points with an unprecedented liquidity flow, which can mean a loan costs of the benefits of 870 billion dollars per year, in addition to the flow of large liquidity sizes to the financial markets.

The average rate on American debt is around 3.3%.

If the raate of every 29 billion dollars of public deficit has been reduced by 300 bps, the US Coulf saves $ 290 billion x 3 = 870 billion dollars / year.

Howver, Refinancel all this debt immediately, be impossible.

Realitiously, 20% can be refined in the year 1 to save ~ 174 billion dollars. pic.twitter.com/v3lbzohyen– The letter Kobeissi (@kobeissileter) July 9, 2025

Urgent interventions to push the US economy can continue to grow and push its annual average to 3.8%, with an increase in the inflation rate exceeding 5% and a decrease in the value of the dollar by 10% compared to its current level, especially since the historical previous precedents warn against the consequences of unavailable cash policies, such as economic stagnation; Note that this rate was reduced by 100 basic points in March 2020, which is the greatest reduction of all time – as an emergency measure to deal with economic withdrawal during the COVID -19 pandemic, not during an economic growth cycle.

Source: Kobeissi’s letter

The analysis of Kobeissi’s letters is also likely to have a lot of prices for asset prices of a possible reduction in interest rates, targeting the S&P 500 level exceeding 7,000 points, the high price of a barrel of oil to exceed $ 80 and the price of the golden ounce at more than $ 5,000. And with it, real estate prices can increase by 25% despite low interest rates on real estate loans from 7% to 4%, with the possibility of improving purchasing power due to high prices.

And the accommodation?

Mortgage rates are falling from ~ 7% to ~ 4% on a market that has already seen prices increase by + 50% since 2020.

We believe that the prices of Wald houses are increasing 25% +.

While mortgage rates drop, the high price increase reveals any improvement in affordability. pic.twitter.com/sx4cz8tder– The letter Kobeissi (@kobeissileter) July 9, 2025

It should be noted that the weakness of the US dollar has already pumped significant investments in alternative assets, the gold share of it came 40% in the last 12 months and 80% in the last five years. Given the Bitcoin Price Association, the opposite of the US dollar, the price of the sector pioneer is a candidate to become one of the largest beneficiaries of the continuous decline in its value.

While the Japanese Energy Consulting Company Recently Succeeded in Collecting A $ 215 million Financing It Allocated to Invest in Bitcoin, Murano Global, Which is listed on the Nasdaq Stock Exchange, Announced the Sale of $ 500 million Shares Allocated to the Bitcoin Currencies (Bitcoin) of the Frequency Changes related to the strategies of managing the assets of the Treasury of Companies Seeking Hedging from Inflation and continuing their monetary assets with the loss of their value.

The technical analysis of the price of Bitcoin currency confirms the possibility of a strong start

By examining the price of 4 -hour bitcoin currency, it is clear that the height is 111,586 dollars, overcoming several resistance levels at $ 10,532, $ 109,745 and $ 110,773 successively before recording its highest level.

Source: Cryptogodjohn on x

Source: Cryptogodjohn on x

It should be noted that the launch of the price exceeds the area of its highest levels recorded recently in the range of $ 109,000 to $ 110,000. The $ 100,375 are to maintain your positive impetus, and its failure to do so could prevail to continue to bleed the losses.

The analysis of the graphic for weekly price movements also indicates that the formation of the upper head and shoulder model, which means that success by hacking the level of the neck can pay the price to gradually increase to $ 132,500.

Source: Cryptogodjohn account on the X platform

This model represents the scope of the assembly of institutions for currency sales during the months of its price, with an extensive wave of stability, and the minimum level formation of the last shoulder is higher than its counterpart to the first shoulder to increase the purchase pressures and the transformation of the momentum into positive.

In addition, permanent term contract graphics show the possibility of skipping the price of $ 112,000, which confirms the force of positive impetus with close background formation which provide a level of support at $ 107,249.

$ BTC

The plan for me is simple here.

Never:

A) We are about to see a break * true *. In which we see acceptance above this beach (daily above, time and space, all re-tests are support, etc.). In which case I will seek to exchange * with * the trend, with targets … pic.twitter.com/8cu5r05we9– CJ (@ cj900x) July 9, 2025

In all, the price can return to the level of fair value of the currency at $ 104,000 and the request range at $ 102,000 because they represent a support zone, but the current penetration force suggests the possibility of continuing the height and increasing the momentum; The penetration of a decisively $ 11,000 barrier and continued to record new high levels allows the price to continue to increase sharply, targeting the barrier of $ 120,000, followed by the penetration target of the upper style and shoulders from $ 131,000 to $ 134,000, with the possibility of withdrawing to rebalance a range of $ 109,000.

The urgent post: Bitcoin-BTC records a new record marking the launch of a new wave of heights appeared first on Arab Cryptonews.