$XRP held steady near $1.42 as volatility fell to levels not seen before a major 2024 rally, raising questions about whether the downtrend is exhausting.

News context

- $XRP has fallen about 61% from its all-time high during the current period of market turmoil, but recent price action suggests the selling may be slowing. Losses have eased in favor of consolidation, with small gains over shorter periods replacing sharp directional moves.

- Notably, $XRPHistorical volatility has fallen to 96, matching levels last seen in June 2024 – a period that marked the trough of an earlier downtrend before a rally in November.

- The squeeze fueled speculation that $XRP could enter a similar base-building phase.

- Some analysts point to parallels with the structures of previous cycles, including the prolonged consolidation that preceded the 2017 breakout.

Price Action Summary

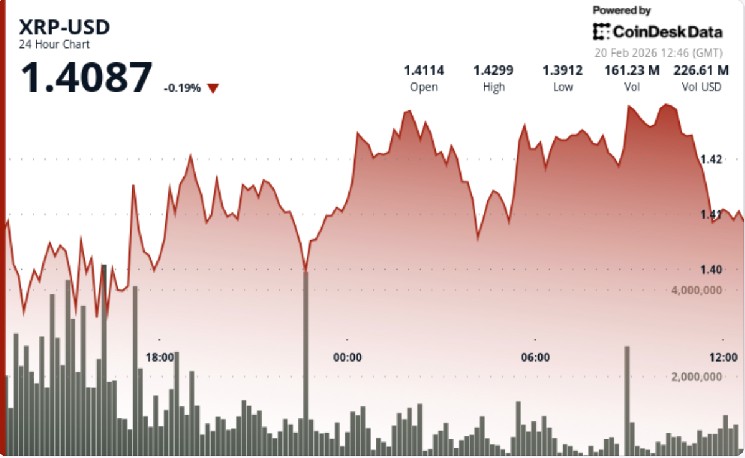

- $XRP fell 0.14% to $1.42

- Price tested and held support near $1.39

- Volume jumped nearly 94% above average during the outage

- Recovery stalled near resistance at $1,428 to $1,431

Technical analysis

- The key moment of the session came when $XRP Tested at $1.3915 on heavy volume before stabilizing. As the rebound completed a 38.2% retracement, momentum faded as the price approached $1.44, the daily pivot and near-term high.

- The structure remains cautious below $1.44 to $1.45, but the successful defense of $1.39 suggests sellers are losing their urgency. Decreasing volume during consolidation indicates compression rather than new distribution.

What do traders think is next?

- Traders view this as a squeeze setup.

- If $XRP recovers $1.44, it opens a margin towards $1.50 and potentially $1.62.

If $1.39 breaks, the downside risk shifts towards $1.35. - With volatility near previous cycle lows, the next decisive move could be less a question of current direction – and more a question of how long this squeeze can last before the expansion resumes.