Bitcoin vs. debate Silver by Peter Schiff: why analysts see Silver as the smartest bet now

As Bitcoin continues its powerful promotion, crossing the $ 116,000 mark, the debate on its sustainability intensifies. One of his most consistent critics, economist Peter Schiff, is doubling his call that Silver, No Bitcoin, offers the best opportunity for investors seeking long -term value, safety and growth.

In a world where digital assets have captured the headlines and dominated portfolio discussions, the persistent position of Schiff on precious metals is attracting renewed attention, especially when Silver silently exceeds Bitcoin’s profits in 2025.

|

| Source: x |

Silver’s quiet rally vs. Bitcoin’s meteoric

Bitcoin has had a 2025 box office success, rising more than 21.5% in the year in which it is directed, fed by institutional adoption, strong ETF entries and optimism that surrounds the cuts of potential rates. But while cryptography dominates financial conversation, Silver has been building its own rally silently. The Ishares Silver Trust (SLV) has increased around 25% of the date, exceeding Bitcoin’s performance in a more stable and less volatile trajectory.

Schiff, in numerous interviews and publications on social networks, has emphasized that although Bitcoin’s increase is impressive, its underlying volatility and its speculative nature leave it vulnerable to acute corrections.

“Bitcoin can be riding a wave of impulse now, but Silver has more space to run,” Schiff said. “Investors should consider getting some profits from the table in cryptography and reallocating La Plata while it remains undervalued.”

Bitcoin vs. Silver: A shock of narratives

The nucleus of Peter Schiff Bitcoin’s argument vs. Silver is about risk management and the nature of value. Bitcoin, largely driven by the feeling of investors, has often shown parabolic price movements, followed by hard corrections. In contrast, silver, with its double role as precious and industrial metal, is anchored by the usefulness of the real world.

The Silver application in electronics, green energy, solar technology and several industrial sectors provides a constant demand that Schiff argues makes it a more reliable long -term asset. “Unlike Bitcoin, silver is not just a value reserve; it is a merchandise with essential industrial use cases,” Schiff said.

Cryptographic whales are listening

Interestingly, Schiff’s perspective is to find an audience among some of the largest players in the cryptographic community. The data of the chain analysis platforms indicate a trend in which cryptographic whales are rotating portions of their substantial Bitcoin profits in precious metals, seeking to diversify and protect the profits.

“Taking profits when the market is hot and reinviring in fundamentally solid and underestified assets with real world is only good portfolio management,” Schiff explained. “Silver offers that path for those who seek to protect themselves against cryptographic volatility.”

Could Silver Outshine Bitcoin in the long term?

In the current economic environment, Schiff does not see Silver’s low performance in relation to Bitcoin not as a weakness but as an opportunity. While Bitcoin and Gold are falling near the historical maximums, the silver remains almost 25% below its previous peak, creating what Schiff sees as an undervaluation window.

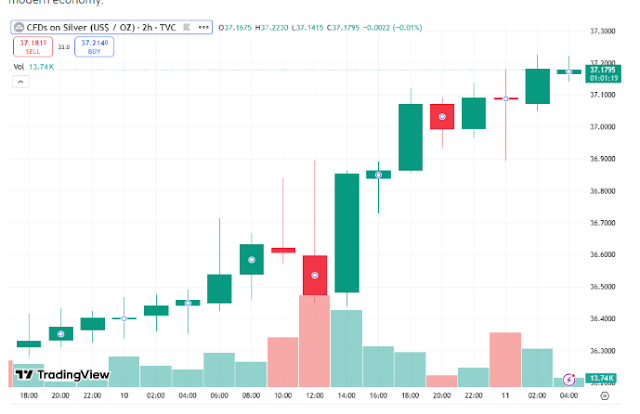

The recent price action supports this narrative. The silver has risen above $ 37.18, backed by a strong volume of constant purchase and impulse. Graphics patterns show a consistent bullish trend, with green candles that dominate recent sessions, a marked contrast with acute price movements already unpredictable Bitcoin.

“If you are looking for growth with a limited inconvenience, Silver is one of the few main assets that that profile still offers in 2025,” Schiff said.

Is a bitcoin correction ahead?

While Bitcoin’s impulse seems unstoppable, many analysts, including Schiff, warn that their meteoric increase could also indicate an imminent correction. Historically, Bitcoin has experienced deep setbacks after acute manifestations, and its dependence on speculative flows makes it susceptible to sudden changes in the feeling of investors.

In contrast, Silver’s role as a defensive asset, along with its growth potential promoted by industrial demand, positions it as a viable alternative during periods of cryptographic market stress.

“If Bitcoin Corrige, we could see a significant rotation in La Plata, which is still undervalued and prepared for a break,” Schiff said.

Cryptographic market dynamics and diversification of precious metals

The interest of the cryptographic community in precious metals is not about abandoning digital assets but about intelligent diversification. In an economic environment that changes rapidly, where inflationary concerns and geopolitical uncertainties persist, keep active with tangible value is considered increasingly prudent.

The Schiff’s argument does not rule out the innovative aspects of blockchain and digital currencies. On the other hand, it emphasizes a balanced approach, recognizing that, although Crypto offers high reward opportunities, it also entails high risk.

“La Plata provides a hedge, a stabilizer for wallets very exposed to cryptographic volatility,” Schiff explained.

Bitcoin, silver and the future of investment

As the mature digital asset market, questions about sustainability, usefulness and value of the real world are becoming central to investment discussions. Bitcoin’s role as digital gold has been validated by institutional interest, but the constant increase in Silver and industrial demand provides a convincing case for inclusion in portfolios with a vision of the future.

|

Schiff’s position is not anti -pto, but pro-reality, such as it framed. Recognize Bitcoin’s value to diversify financial systems, but warns of overexposure to a single highly volatile asset.

The way ahead: monitoring of market changes

As Bitcoin pushes new maximums and silver in silence, the debate between Bitcoin de Peter Schiff vs. Bitcoin vs. Silver is emblematic of a broader conversation in financial markets: how to balance growth with stability.

Investors are very closely observing the next movements of the cryptographic market, especially with the volatility of Bitcoin prices and the market corrections potential. At the same time, the underground current of industrial demand and real world applications continues to strengthen Silver’s position as a practical investment option.

Final thoughts

The Bitcoin vs. debate Silver by Peter Schiff is not simply a conversation about the price action, but a reflection on investment philosophy in a rapid evolution market. While cryptography remains a powerful force, the fundamental strengths of Silver, the lower volatility and industrial relevance make it a serious contender for investors looking for balanced portfolios.

As Bitcoin continues to capture the headlines and retail emotion, Silver’s constant rise could become the quiet revolution in the preservation of wealth. For those who seek to navigate the complex market environment of 2025, the Schiff’s message is clear: it can be time to consider silver, not as a replacement for Bitcoin, but as a strategic complement in a diversified investment strategy.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.