Bitcoin is still nearly $ 107,500 in a limited range between $ 10,450 and $ 108,980 during the American negotiation session on Monday. Although the price movement remains very calm, the frequency of the institutional momentum on the market increases, Strategy (Michael Saylor) – The new name of Michael Saylor – has the purchase of 4,980 Bitcoin currency worth $ 531.9 million, with an average purchase price of $ 70,982. With this, the total company has a total of 597,325 BTC currencies, which supports its position as a larger company for Bitcoin in the world.

Michael Saylor annually another purchase of massive bitcoin:

Strategy acquire 4,980 BTC for $ 531.9 million at an average price of $ 106,801.

They now hold 597,325 BTC – were originally brought to $ 42.4 billion.

Average price? $ 70,982.

The Playbook is not a case: buy bitcoin, keep to always and leave time … pic.twitter.com/dqiqevx1qCYGNE (@Swan) June 30, 2025

In the rapid purchase wave, Japanese Metaplanet added 1,005 BTC currencies to its full value of $ 108 million, which increased its balance to 13,350 bitcoin pieces currently estimated at around 1.45 billion dollars. Metaplanet financed this agreement using exempt bonds of interest and revealed ambitious plans to have 100,000 Bitcoin currencies by 2026 and 210,000 currencies by 2027. In this context, the company’s CEO – Simon Gerovich – explained that Bitcoin’s investment for 2025 has already reached. 349%.

On the other hand, the company’s shares have increased by 9% to be added to annual gains above 350% since the start of the year.

Metaplanet has exceeded the Cleanspark mining company to become the largest holder of the company $ BTC After buying 1,005 BTC for $ 108 million.

The company now holds 13,350 BTC acquire for approximately $ 1.31 billion at $ 97,832 per bitcoin. The treasure is worth $ 1.45 billion. pic.twitter.com/ivdkctdvva– Satoshi Club (@esatoshicub) June 30, 2025

With the succession of institutional purchases, the mood of the market seems optimistic about optimism, which can open the way to a possible penetration above the resistance zone at $ 109,000.

The Robinhood platform supports the spread of digital currencies and actions represented in Europe

The Robinhood platform has completed its official expansion on the European market, relying on the Bluechen Arbitrum, which is an expansion of the second layer on the Ethereum block. European users can now exchange American actions and ultimately representative numerically for digital currencies with a financial lever that can reach 3 times, which increases competition in the central and decentralized commercial platform sector.

Robinhood Launensers Stock and Perpetual Futures Trading in Europe

►– Decrypt (@DecryptMedia) June 30, 2025

The new products that have been proposed include:

- A special expansion solution for the second layer of the Ethereum block focuses on active active ingredients (RWA).

- Mortgage services for Ethereum-Eth and Solana-Sol in the United States only.

- Exchange of currency exchange costs of 0.1% to improve the efficiency of transfers.

- Kripto tax management tools and a bank card to pay digital currency with a cash recovery function.

Although this expansion temporarily turns attention to Ethereum, it supports the infrastructure of the digital currency sector in general, which is beneficial – indirectly – on the adoption of the Bitcoin part on new markets.

Technical expectations of the price of Bitcoin currency: be careful to penetrate the level of $ 109,000

Technically, the price of bitcoin always moves in a transverse range by maintaining its stability at the upper average of movement if with the last 50 commercial candles at $ 107,377, while the momentum decreases gradually. The MacD index diagram is recorded with a developed track and a rapprochement of signal lines near zero level, a model which generally distinguishes the stages from the previous cohesion from a decisive movement.

Important technical levels of surveillance:

- Resistance: $ 108,980 and $ 110,448, then $ 111,944

- Support: $ 106,450, then $ 104,840, followed by $ 103,030

Possible negotiation plans:

- Scenario Amount: Entrance when the hack is confirmed more than $ 109,000, with objectives at $ 110,448 and $ 111,944

- The downward scenario: Sell less than $ 106,450, with objectives at $ 10,840 and $ 103,030

Unless this range is broken, traders should be patient while maintaining a neutral aspect when the price of the Bitcoin currency price; It is likely that the closure outside the current canal – especially if it is accompanied by the reduction volume – will be determined towards the next movement.

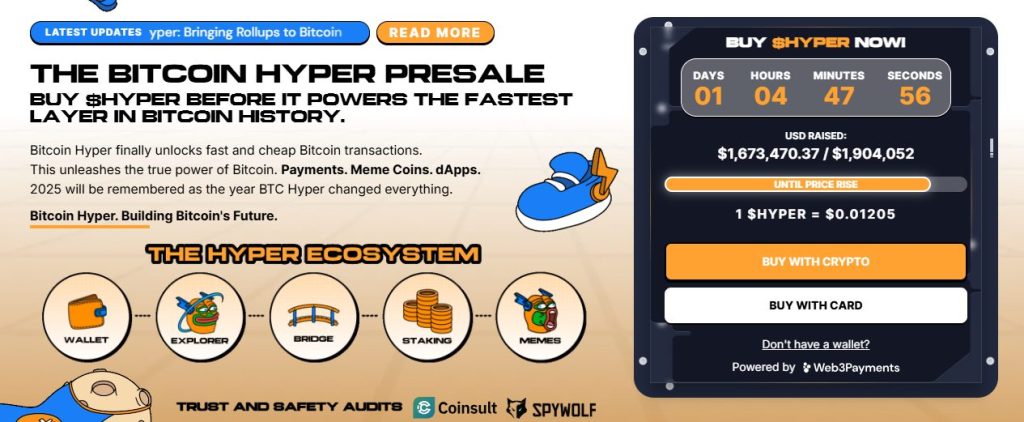

The result of Bitcoin Hyper is more than $ 1.74 million, as the price approaches

Bitcoin Hyper succeeded – planned for the first Bitcoin Bluex extension solution from the second Virtual SOLANA Virtual Machine Second – with funding of $ 1.74 million, and its result recorded $ 1,748,091.98 of $ 1,974,249. The currency is currently sold to $ 0.012075, and it is expected to increase in a few hours by its new phase.

With its design to combine the safety of the Bitcoin blockchain and the speed of the Solana blockchain, the project works to provide the advantages of intelligent contracts and develop decentralized applications (DAPS) and the possibility of launching and circulating the high -speed high -speed currencies at low cost, with a fluid link with the Bitcoin network. On the other hand, the intelligent project of the project was designed to guarantee the possibility of developing, reliable and simplicity – has successfully suffered the Coinsult.

Thanks to its insurance for all the attractiveness of MG currencies and practical functional uses, Bitcoin Hyper becomes one of the most eminent competitors of second layer solutions for the year 2025, in particular after having acquired a strong dynamic following its unique mortgage mechanism and its exciting and complete launch to solve its new solution during the first quarter of next year.

The expectations of Bitcoin-Btc Bitcoin-Btc prices: Robinhood and Strategy to support the updated momentum appeared first on Arab Cryptonews.