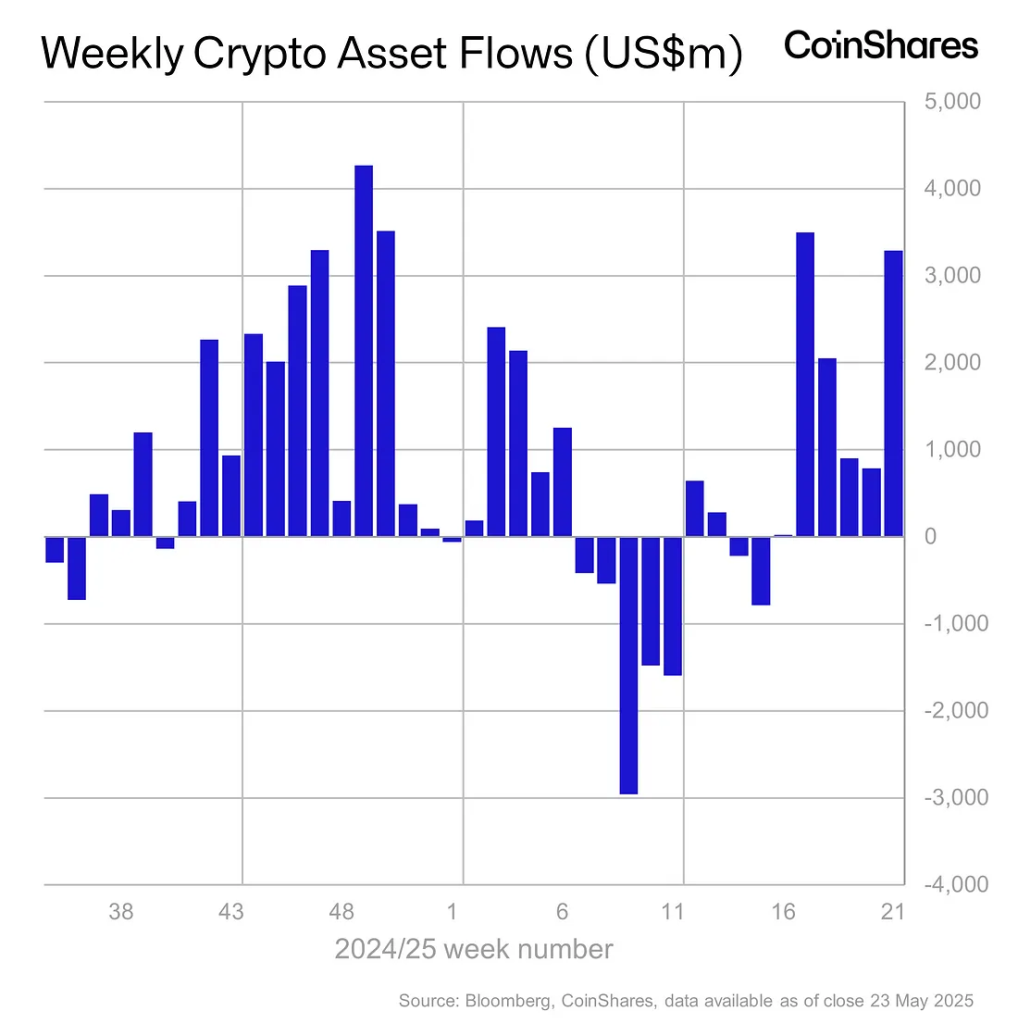

The price of Bitcoin continues to be around $ 10,250, increased investments received in Bitcoin ETF and the increase in vagueness of macroeconomic conditions; Coinshares’ data has shown that the initiative of investment institutions to pump $ 3.3 billion in the Bitco ETF only last week, reaching a total of $ 10.8 billion since the start of the year.

BITCO-BTC has increased as an active that can be added to the assets of investment bags in order to diversify their categories, in particular with the growing income of the US Treasury obligations and the ambiguity of monetary policy prospects, so that the United States exports the list of largest beneficiaries of these funds of 3.2 billion dollars, followed by Australia, Hong Kong and German succession. less.

But not all investments were positive. Ripple-XRP experienced investments of $ 37 million, ending its 80-week series of gains to lead Bitcoin-BTC and Ethereum-Eth.

The general mood of the market indicates the strength of investment institutions and the trend of small investors to alternative currencies

The institutions are betting on Bitcoin as a tool which is a tool in the midst of current macroeconomic conditions, while small investors are determined to prove, with the transformation of the interests of crossed societies on social media platforms into modest market values such as the two flops (FPPE) and Fartcoin the price of bitcoin.

While cryptocurrency blockocoching data have shown that 99% of Bitcoin owners are currently on an uninterrupted benefit, a level linked to excessive euphoria and at the initiative of some to make profits.

UTXOS monitoring uses to obtain

– UTXOS (transaction outputs not spent) are the technical mechanism which encloses a single BTC can only be spent on the blockchain. They also allow us to assess the unpaid profits on all expenditure … pic.twitter.com/hfvfu4bchw

– Darkfost (@darkfost_coc) May 26, 2025

As the price of the BTC is the highest level of $ 109,000, traders question the possibility of continuing to increase in the middle of the growing atmosphere of uncertainty on the macroeconomic economy; The high yields of the US Treasury bonds, the possibility of Moody’s to reduce the credit rating and geopolitical concerns, all investors maintain constant tension, but the enjoyment of Bitcoin force increases these circumstances improves its double role of high risk investment and a safe refuge at the same time.

Technical analysis and the most important levels of Bitcoin prices

Bitcoin two -hour price movements indicate its stability to the highest average miraculous intermediate index of 50 hours, each of two hours (EMA 50) at $ 108,731 and a stable rise line at $ 102,190; Where the level of the extension of Fibonacci was 0.236, a barrier at $ 109,653, with a guide to form the negotiation candles extended to the tail and other doji in contact, in an indication of a frequency state.

The MacD index also suggests the possibility of a rising intersection as its steering line approaches the intersection with its counterpart for the signal and its transcendence, but this momentum still needs a special confirmation with the decline of the green sign columns.

- Resistance barriers: $ 109,653, $ 111,935 and $ 113,300, respectively.

- Support levels: The closest to $ 108,731 (corresponding to the EMA-50 index), $ 107,078, then $ 105,905. The prices will be confirmed to enter a barrier of $ 109,653 when an upward swallowing candle appears or the artistic model “three white knights” forms; It can go to $ 111,935 and perhaps $ 113,300 if its launch is accompanied by growing commercial sizes. On the other hand, its cohesion failure at $ 108,731 could decrease to $ 107,078 and maybe $ 105,905.

Currently, clear signs must wait before entering, so that the price of bitcoin in the face of macroeconomic fluctuations indicates promising prospects in the predictable term.

Exciting mortgage income at a rate

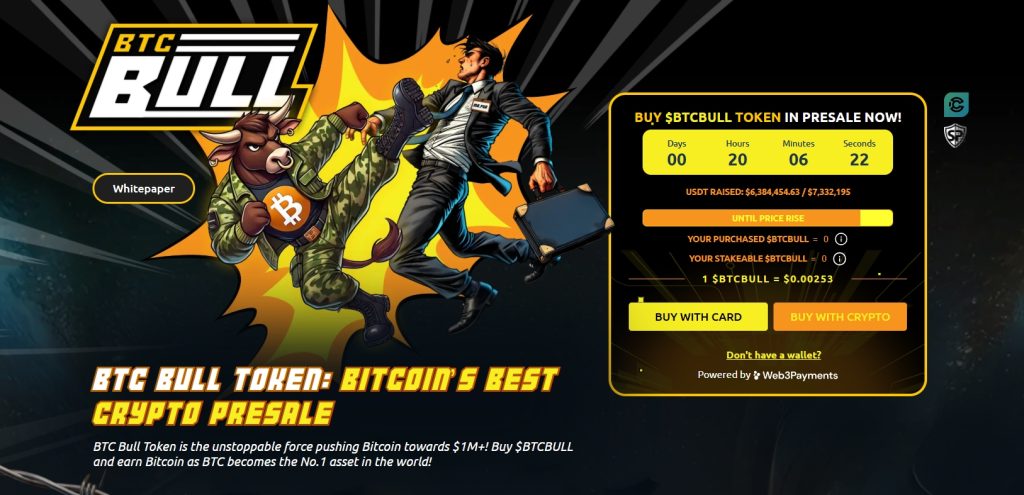

With the stability of the price of bitcoin around $ 10,250, attention has been transformed into promising alternative currencies, including BTC Bull (BTCBLL), which has so far managed to collect $ 6.45 million with the price approaching the price.

Bitcoin awards and successive reduction in the offer

BTC Bull works according to a single mechanism; The higher the price of Bitcoin, the more the free BTC sales received by the owners of BTCBLL, while stressing that the participants in the subscription have a priority which receives rewards, and its fascinating mechanism also provides the most important characteristics:

- A BTCBLL sequence displayed at each BTC price increased by $ 50,000 in order to provide it with rarity.

- The currency price is currently $ 0.002,535 before increasing the prescription.

This approach balances the beginning of bitcoin and BTCBLL value, because it is attached to the functionality of rarity through pre-combustion operations.

Mortgage conditions to receive returns without problem

The BTCBLL mortgage complex currently includes 1.62 billion currencies, providing 64% annual returns, as well as:

- Do not stipulate the periods of crisis of the mortgaged currencies or the costs incurred to withdraw them early.

- Provide by pulling the mortgaged sales if necessary.

There is no doubt that this approach responds to the aspirations of foreign exchange owners looking for yields without adhering to complex conditions or exposure to the risk of rarity of liquidity.

A strong momentum in preparation to achieve the target result

With just over a million dollars to collect during its last stages, participants rush to the early purchase and the work mechanisms of the project – as bonuses associated with the launch of Bitcoin and the gradual reduction of the offer via the burning mechanism, contribute to separate mortgage options – to stimulate participation.

The most important data:

- The outcome of the subscription (USDT): $ 6,384,454 on $ 7,332 195

- The current price: $ 0.002535

BTCBUL provides an exciting annual yield of 64% in the mortgage complex based on Ethereum (which currently includes 1.61 billion BTCBUL), without any compulsory detention period or incurred early withdrawal fees, which means receiving a yield without problem and complete liquidity.

Follow us on Google News

The expectations of the Bitcoin price after the stability of the BTC price are $ 109,000 and the pursuit of its stock boxes (ETF) by receiving investments in the midst of macroeconomic transformations appeared first on Arab Cryptonews.