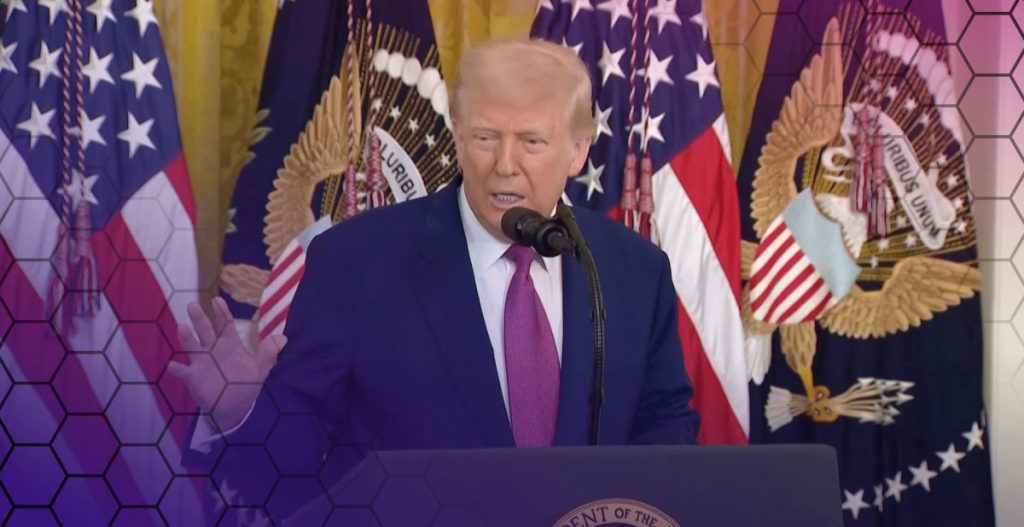

President Donald Trump made the tone for his public conflict with the president of the federal reserve Jerome Powell after having described him as a “fool”, but he signed up – at the same time – not to reject his position despite his growing frustration following the federal reluctance to reduce interest rates; During his speech to the White House Thursday, Trump directed his maximum monetary policy criticism pursued by Powell, saying that only 1% of interest rates would provide $ 300 billion a year in the United States, while it can reduce it by 2% to provide around $ 600 billion.

Why does Trump want to “impose a procedure”?

Trump’s latest verbal attacks are the third public targeting by his Administration of Powell within two days, and he was preceded by similar criticism from the Minister of the Trade, Haward Lunick and Vice-President JD Vance, who accused the federal “of the poor management of monetary policies”.

The previous haas has said it for a while, but it’s even Moare: https://t.co/hqujwxwchs

– JD VANCE (@jdvance) June 11, 2025

The coordinated pressure campaign follows from the impatience of the Trump administration towards the independence of the federally, in particular the approach of the president’s confrontation with the pressures of the mid-term elections and his efforts to review his economic capacities, but Trump stopped the threat of rejecting Powell of his post despite his recitation of the prodigy of the procedure of the decision of the decision to decision From the decision to make the decision, indicating – instead – to this “possibility of imposing a procedure” if the launch of an interest rate chain does not start soon.

It seems that the time of Trump’s criticism has a strategic dimension due to the new data on economic indicators, which reveal the slowdown in inflation rates and the drop in prices of fossil energy as a result of an approach to continue to dig within the framework of its energy -related policies, called “continuous pits”.

It is noteworthy that the Current State of Powell Will End in May 2026, and Trump has glimpsed his statement about an important declaration about his candidate to take over the next state, and Harvard Legal Experts Believe that Trump has the constitutional authority to dismiss powell, but this step may Markets and WeAkens the LIVABILITY OF THE FEDERAL RESERVE AS THE PARTY THAT IS ENTRUSTED WIL WITH FIGHTING INFLATION, WHICH MAY LEAD TO LONG -TERM INTEREST RATES INCREASE EVEN IF THESY ARE REDCED Initially.

The presidential pressure campaign exacerbated the controversy over the independence of the federal

The climbing of the confrontation between Trump and Powell represents an institutional confrontation linked to the independence of the federal reserve and the deep constitutional and economic consequences, and the frustration of Trump stems from his conviction that current interest rates cause consequences which can be avoided linked to the cost of the loan, in particular in light of the short -term borrowing obligations, which were approved by administration. Biden.

For his part, Trump declared – in his argument – the initiative of European countries to reduce interest rates 10 times without following the federal reserve this approach, even once, despite the similarity of economic conditions and the drop in inflation indicators; Experts believe that the 1913 federal reserve law authorizes the abolition of the governor of the American central bank for “a good reason”, but recent decisions of the Supreme Court have gradually suppressed the expression “for a good reason” that independent agencies have continued to protect for 85 years.

On this subject, a graduate of the law faculty of the University of Harvard and a former member of the Board of Directors of the Federal Reserve of Daniel Tarullo spoke of the aisle of three conservative judges according to which the federal reserve can be processed differently from the rest of the agencies, and perhaps that an exception is inspired by the history of the Central Bank which began since the era of the first and second Egyptians of the United States.

However, market mechanisms can guarantee Powell protection more than law; It can be expelled by arousing immediate and violent reactions on the markets which can hamper Trump’s economic objectives, and this expected volatility is a strong means of deterrence in the face of the current president, in particular with the prosecution by Scott are putting income from the bonds of the treasury due to the stable 10 years, which is necessary to take investments and economic decisions.

The latest data for economic indicators argue that Trump immediately followed the monetary facilitation approach; Inflation data reveal continuous stability and a decrease in energy costs, thanks to the expansion of the oil extract locally.

In the end, readings of the reader price index (PPI) for the month of May contributed to calm the concerns about the possibility of inflation following the war of customs rights, and this may have encouraged the administration to put pressure on the federal reserve in the middle of the anticipation of the markets to start a reductive interest rate chain later this year.

The post Donald Trump warns that it “imposes a procedure” if the federal reserve does not indicate interest rates, but Powell’s survival in its position remains preserved appeared first on Arab Cryptonews.