Bitcoin and Ethereum Currency on the Stock Exchange (ETF) recorded starting investments of 244 million dollars on September 23, representing the second consecutive day of the withdrawal of investors.

This occurs after investors have undergone serious loss of $ 439 million the day before, as investors have re-positioned in the light of recent federal reserves of interest rates and expected American inflation data.

The losses of the stock exchange boxes highlight investors’ caution with the fluctuations facing Bitcoin and Ethereum Daily Daily Daily

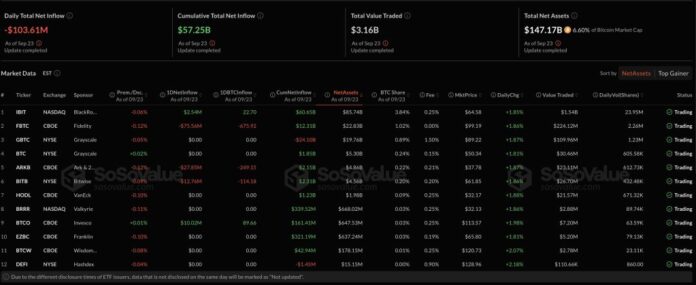

According to Sosovalue data, Immediate Bitcoin Bitcoin negotiation boxes experienced net loss of $ 103.6 million on Monday.

Fidelity’s Fidelity Fundlity seemed to be the biggest losers because it saw $ 75.6 million, followed by Arkb 21Shares, which lost $ 27.9 million.

On the other hand, the BlackRock Ibick Fund has experienced new modest investments of $ 2.5 million, while the Investco BTCO fund recorded the highest new investments during the day at a value of $ 10 million.

The GBTC (gray levels) and Hodl Hodl (Vaneck) boxes and the Valkyrie Brrri box have not witnessed new investments.

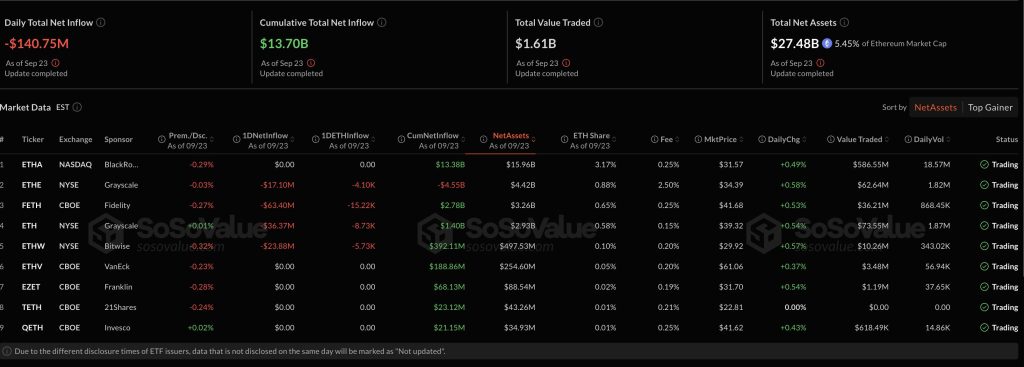

In addition, the ETH ETF scores of the Stock Exchange have recorded larger losses of $ 140.7 million in one day. Fidelity Federal Fund witnessed the highest losses, reaching $ 63.4 million, followed by the Gray ETH Fund, which lost $ 36.4 million.

In addition, the Bitwise Ethw fund has also experienced significant starting investments worth $ 23.9 million, while Ethe Ethe Fund has recorded $ 17.1 million.

The company Black Rock and ETHV remained without significant change, without showing the small boxes of Franklin, 21 shares and inveso no major change.

It should be noted that on September 22, the Bitcoin currency funds on the Stock Exchange (BTC ETF) recorded losses of $ 363 million in a session led by Fidelity Fidc Fund, which recorded $ 276.7 million.

The same day, the ETF (ETH ETF) were observed by $ 76 million led by Fidelity Fund, as well as Bitwise and Etha’s Etha Rock Fund.

As of September 23, FNB Bitcoin Spot were maintained with a net asset of $ 147.2 billion, or 6.6% of the total market value of digital currency, and cumulative investments amounted to $ 57.25 billion.

As for the ETHEREUM SPOT ETF, they now maintain net assets of $ 27.5 billion, or 5.45% of the total market value of the currency, with cumulative investments reaching $ 13.7 billion.

It should be noted that these losses began a week after the record for digital asset products for new investments approached $ 1.9 billion, according to Coinshares data. This increase occurred after the first reduction in interest rates for the year 2025, which led the renewed demand for investors to be exposed to digital currencies, despite the warnings of decision -makers.

Bitcoin Bitcoin Funds attracted investments of $ 977 million this week, while Ethereum Products recorded investments of $ 722 million, reaching a new record since the start of 12.6 billion dollars per last.

In all cases, market data show that investor positioning is always sensitive to macroeconomic signs, and analysts note that the investment of exchange funds (ETF) and derivative leverage levels are always the main indicators that must be monitored because the markets are absorbed by the directions of the federal policy of the reserve and inflation policy.

Blackrock Blackrock Boxes (BlackRock) Blackrock (BlackRock) is exported a wave of income of $ 260 million, while Ethereum is added $ 42 million

Bitcoin and the FNB and the ETF Coin have been successful in recent years.

FNB Bitcoin and FNB ETFs are now more than BlackRock more than $ 260 million per year, proving that digital asset products have become a major engine for the largest asset manager in the world.

Blackrock Genesss 260 million dollars a year from Bitcoin and Ether while the institutional adoption of Wall Street reactivates new heights.#Bitcoin #Ethereumhttps://t.co/0dagyws3jz

– cryptonews.com (@cryptonews) September 23, 2025

According to Leon Waidmann, head of the ONCHAIN Foundation Department, Black -crock is Black Rock, which represents $ 218 million in this number, while Ethereum costs only $ 42 million.

On this subject, Wadman said: “The case is no longer an experience”, noting that the company has transformed the digital currency boxes circulating on the stock market into a source of income which corresponds to established financial products.

Analysts note that Black Rock will define a standard for pension funds, sovereign funds and insurance companies that study exposure to digital assets.

In addition, the large boxes of the boxes exchanged at the Bloomberg Stock Exchange (Eric Balchunas) highlight the structural advantages of digital currency boxes circulating on the stock market, which combine immediate access, low costs and the possibility of reaching yield, as well as organizational and confidentiality protection, which are generally not associated with the property digital growth.

The FNBs have offered everything tokens: instant access, tiny costs, flexibility, yield (you can completely invite ETF). But with additional advantages that tokens do not have: the ranging (huge) protections, anonymity and a number 1-800 * Convertment immediately Moues lol * https://t.co/5wpm79aemw

– Eric Balchunas (@ericbalchunas) September 24, 2025

As for market conditions, they are still different, because Bitcoin is negotiated at $ 113,717 on Monday, 0.9% in the last 24 hours, but it moves in a narrow range between $ 111,369 and $ 113,301.

For its part, the price of Ethereum decreased by 0.4% to $ 4,173.88, according to a decrease of 7.1 during last week. Despite short -term fluctuations, some sector leaders believe that growing institutional demand represents a long -term trend.

Finally, Micheal Sailor, director of strategy, said that CNBC boxes are circulating on the stock market (ETF) and companies combining the purchase of large amounts of bitcoin that surpass a lot that is produced daily, creating sustainable pressure in the price trend of prices. On the other hand, Citigroup is cautious about Ethereum, because you expect the price to reach $ 4,300 by the end of the year, which is much lower than its highest price ever high, $ 4,953 in August.

The position that Bitcoin-BTC and Ethereum-Ethem-Etage-Ethereums attend huge losses of $ 244 million for the second consecutive day appeared first on Arab Cryptonews.