Bitcoin-BTC exceeded an obstacle of $ 100,000 to exchange approximately $ 10,688, in a realization which represents weekly gains of 7.6%, fired by solid institutional investments and positive news linked to macroeconomic factors.

For example, Goldman Sachs recently revealed that he had invested $ 1.65 billion in Bitcoin through the stock exchange (ETFs) Fund (Blackrock) and Fidelity – and the increased recognition of Bitcoin as a worldwide.

Goldman Sachs discloses $ 1.4 billion #Bitcoin via BTC-Etef. pic.twitter.com/dqivlnytmt

– Cryptonews.website (@cryptonewsweb) May 10, 2025

On the other hand, aRelease The Japanese company Metaplanet (Metaplanet) obliges a value of $ 21.25 million to increase its possession of Bitcoin, which will allow the company to buy 206 BTC currencies according to its current price, by strengthening its position within the main world owners of public companies.

* Metaplanet issues USD 21.25 million in ordinary 0% bonds to buy $ BTC* pic.twitter.com/tofk3rkmo8

– Metaplanet inc. (@Metaplanet_jp) May 9, 2025

These procedures also reflect a more complete trend between companies seeking to diversify the assets of their general budget by relying on Bitcoin as a strategic investment rat.

The trade agreement between the United States and the United Kingdom contributes to improving the general mood of the market

To strengthen positive public mood, forecasts near the approval of a new trade agreement between the United States and the United Kingdom have contributed to the wave of Bitcoin altitudes; President Donald Trump recently referred to the proximity of a new trade agreement between the two countries, which makes market concerns as a lack of certainty on customs prices.

While continuing to consolidate trade relations between the two poles, the general mood of investors continues to improve, which can push investors to high -risk assets – as BTC – to benefit from increased optimism.

The British agreement approved by Trump establishes the standard for future new commercial plans with America https://t.co/wlxxhw7cgt

Just in: President Trump announced the "Historical" Details of his agreement with the United Kingdom:

"The agreement includes a plan that will bring the United Kingdom to the … pic.twitter.com/kfm6zbisdt– IAM Breitbart (@jacsarobahs) May 8, 2025

This news has intervened after the decision of the Federal Reserve to maintain interest rates unchanged in a range of 4.25% to 4.50%, which contributed to the growing demand of investors to high -risk assets, to trigger the total positive developments in the economy – as well as the drop in trade tensions – the interest of investors in new assets like the oldest BTC.

Bitcoin levels worthy of surveillance

From the Point of View of Technical Analysis, the Bitcoin Price is Currently Witnessing Stability Below the Level of Resistance that corresponds to the Level of Critical Fibonacci Extension at $ 103,681, and if the price is successful in its penetration, it will go towards the level of the fibonacci extension 2.618 At $ 105.249, Which will be an Increase of 1.5%, But the MacD index direction Line Started to Show Signs on Downward Intersection possible, indicating the possibility of going through an imminent correction wave.

- The nearest resistance barrier: $ 103,681 (corresponding to Fibonacci 2,272)

- Next barrier: $ 105,249 (Fibonacci extension 2.618)

- The nearest level of support: $ 102,448 (Fibonacci 2.0 correction level)

- The following level of support: $ 100,717 (Cibonacci Correction 1.618)

Trading parameters suggested:

- Purchase: with level penetration $ 103,681

- Great benefits: At $ 10,249

- Stop losses: $ 102,448

Commercial strategy: You can buy after entering the barrier of $ 103,681, and the objective reached an extension of $ 2,618 to 105,249, with an order to stop the lower losses in terms of $ 102,448 with a small blanket of the drop of decline, the drop below this level can increase a stronger correction wave.

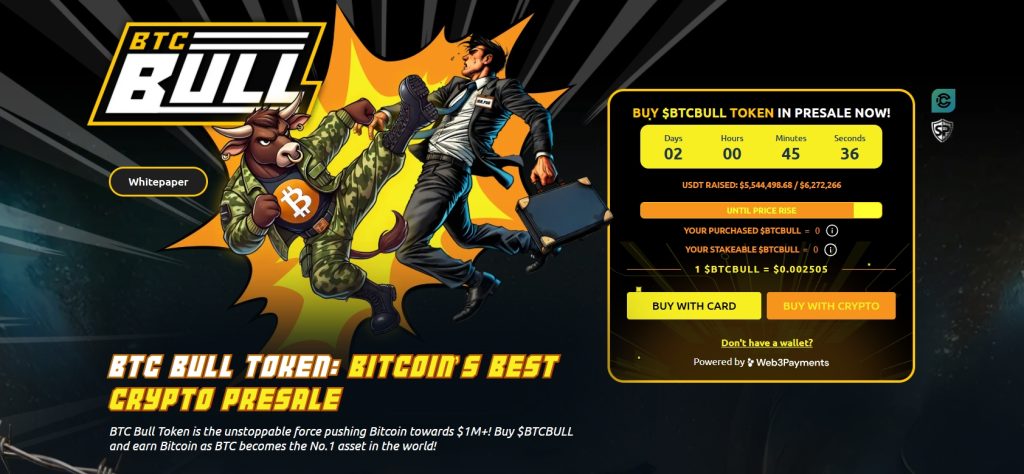

Mortgage flexibility with a yield of 74% attracts new investors and pays the results of BTC Bull to exceed 5.58 million dollars

BTC Bull (BTCBLL) continues to grow, which has so far surmounted $ 5.58 million and approaches its target of $ 6.27 million. Despite its low price of $ 0.002505, BTCBLL has proven to be more than just MM, it offers real advantages thanks to rewarding yields for the flexible mortgage.

Financial statements derived from practical uses are designed to ignite demand

Unlike traditional MIM currencies, BTCBLL has managed to combine the attractiveness of chipto cultivation with concrete mortgage yields, its mechanism currently allows its investors to gain annual yield (APY) at a rate of its unique mechanism, in particular in the atmosphere of highly fluctuated investors.

Current subscription data:

- The result: 5.544 498 USDT on 6,272,266 USDT

- The current BTCBull Prize: $ 0.002505

- Total mortgage complex: 1 342 549 903 BTCBULL

- Expected return: 74% per year

And since there are only $ 700,000 remains to collect it before the specified date, the time remaining to participate quickly is about, because the BTCBLL currency is an ideal option for investors who seek to obtain high yields while benefiting from flexibility which offers liquidity if necessary during the exciting CRAPTO cycle of 2025.

Follow us via Google News

Is the expectations of the Bitcoin price with $ 103,688 with an increase of 7.6% in a week, will the price of the BTC mark its new level before June? APPLERDIRST on Arab Cryptonews.