According to venture capitalist Nic Carter, major institutions holding Bitcoin may eventually lose patience with Bitcoin developers who do not respond quickly enough to issues related to quantum computing.

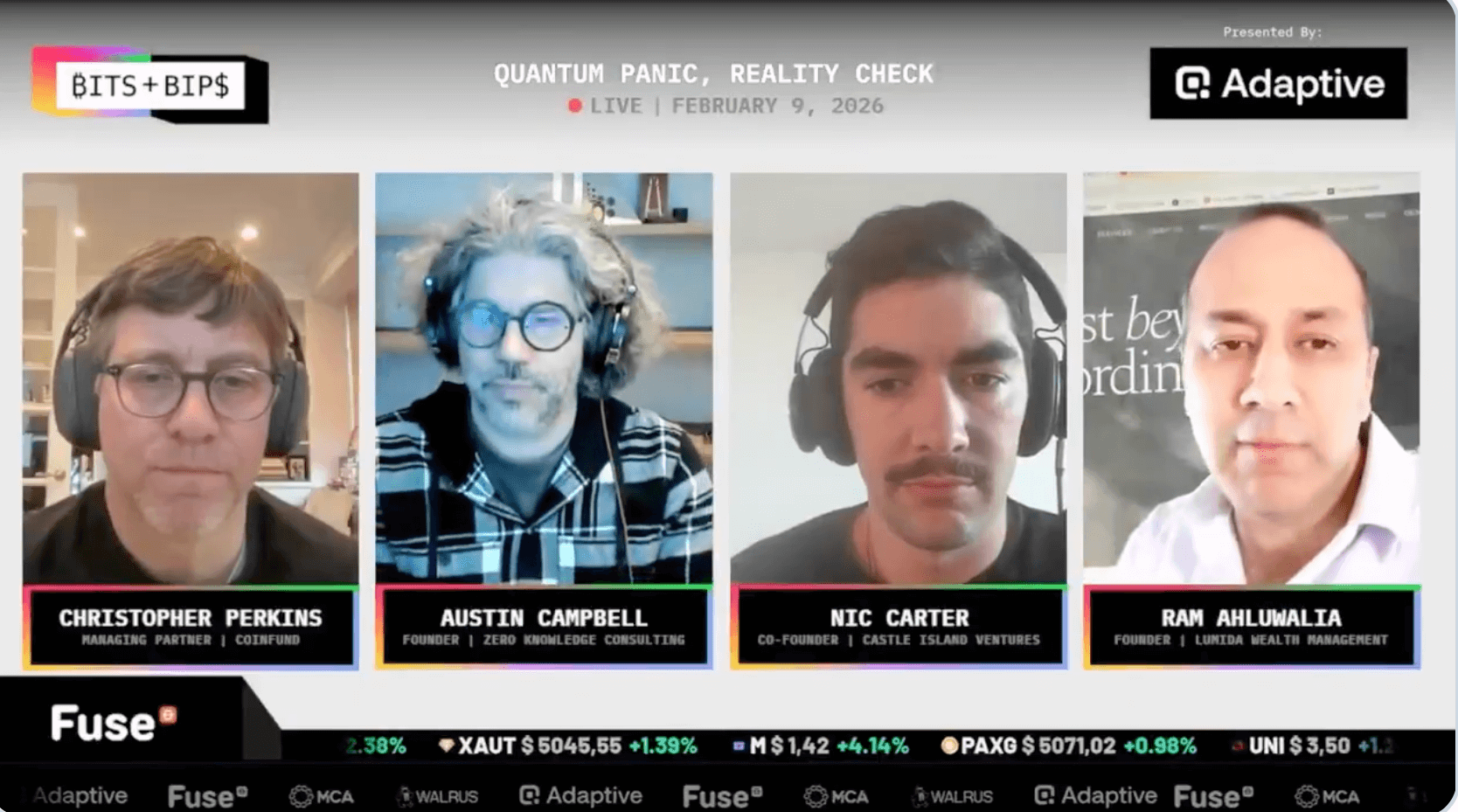

“I think the big institutions that are out there now in Bitcoin, they’ll get fed up, and they’ll fire developers and hire new ones,” Carter said during the press conference. Bits and pieces Podcast episode released Thursday.

“I think developers will continue to do nothing,” Carter said.

Source: Cointelegraph

“If you’re BlackRock and you have billions of dollars of client assets in this matter and its problems aren’t resolved, what choice do you have?” he said.

‘Business buyout’ a possibility, says Carter

BlackRock, the world’s largest asset manager, holds approximately 761,801 Bitcoin (BTC), valued at approximately $50.15 billion at press time. This represents approximately 3.62% of the total Bitcoin supply.

Carter warned that if Bitcoin developers don’t move quickly to implement quantum-resistant cryptography, it would lead to “a corporate takeover,” arguing that it would be “a success story.”

Nic Carter joined three other crypto executives on the Bits and Bops podcast on Thursday. Source: Laura Shin

Zero Knowledge Consulting founder Austin Campbell echoed a similar sentiment. “If there is a structural problem here, and they have a broad view, eventually they will be forced to speak out,” Campbell said.

Carter recently spoke about the threat that quantum computing poses to Bitcoin. He said on January 21 that the “mysterious” underperformance of Bitcoin prices was “driven by quantum” and was “the only story that matters this year.”

Bitcoin is trading at $70,281 at press time, down 26.25% over the past 30 days, according to CoinMarketCap.

However, not everyone agrees that institutions would attempt to influence the network. Lumida Wealth Management founder Ram Ahluwahlia said major Bitcoin institutions are “passive” investors. “They are not activists,” he said.

Industry divided on urgency of Bitcoin quantum risk

This comes as the industry as a whole continues to debate whether the threat to Bitcoin really is imminent.

Related: Bitcoin Tops $69,000 on Slower US CPI Print, But Chances of Fed Rate Cut Remain Low

Capriole Investments founder Charles Edwards sees quantum computing as a potential “existential threat” to Bitcoin, arguing that an upgrade is needed now to strengthen the network’s security.

Meanwhile, Christopher Bendiksen, head of CoinShares Bitcoin research, claimed in a post on Friday that only 10,230 Bitcoins out of 1.63 million Bitcoins were in wallet addresses with publicly visible cryptographic keys and vulnerable to a quantum computing attack.

Some Bitcoiners, such as Michael Saylor, executive chairman of Strategy, and Adam Back, CEO of Blockstream, believe quantum threats are overblown and won’t disrupt the network for decades.

Review: Brandt says Bitcoin is still at the bottom, Polymarket sees hope: trade secrets