The latest Bitcoin-BTC price movements increase $ 105,000, the attention of technical analysts; Once its history has exceeded the threshold of six boxes, the price of Bitcoin has formed a classic symmetrical triangular model on the periphery of completion, because the interest in this artistic style is not only attributed to its form, but to the convergence of several artistic factors which preach a strong start.

The style of the triangle shown on the diagram for two hours shows a series of descending peaks that meet with ascending stockings, composing a compression zone which generally led to a strong movement in a specific direction. The trend lines are close to $ 105,500 to be imposed on merchants to make their own decisions in the next 24 to 48 hours.

Bitcoin’s artistic indicators flashed in green

The current artistic scene clearly seems biased towards the benefit of rackets:

- Obvious divergence cannot be ignored Relative power indexThe index is a higher background at a time when the price has experienced a temporary drop, which is considered a traditional reference to the decline in the descending momentum.

- Either MacD, It went from the negative zone (8.218-) to positive (218+) with the intersection of the blue line on the signal line to indicate the rising momentum.

- He works Movement so average of the last 50 commercial candles $ 10,420 as a moving support level which helps to absorb frequent price reductions.

Among the most important indicators during the secondary trading phase is the behavior of the trading volume, it has gradually decreased with the development of the technical model, that technical analysts consider a positive indication which precedes the expected beginning, and this decrease can increase the health of the artistic style and the assumption of assembly is probably at the expense of the discharge.

Does the Bitcoin price trading strategy for triangle model: does the price of bitcoin approach?

The expectations of Bitcoin prices remain neutral at present due to the shape of the symmetrical triangle model which restricts its movement in a narrow beach. As for traders who seek to exploit this expected scenario, the strategy seems simple because it is correct, stressing the importance of timing.

The traditional entry point occurs when a clear penetration of $ 106,767 occurs, provided that there is confirmation of the price of the price and the size of trading together. We extract the technical objective of measuring the height of the triangle and its fall from the penetration point, to indicate the price of $ 109,000.

#Bitcoin Triangle of $ 105,000 Compression: 6% rally on the bridge?

Symmetrical triangle nearly $ 105,000

Divergence RSI + MacD Haussier crossroads

50 EMA = strong support

Decrease the volume = pre-paau

Target: $ 109,000 in breach greater than $ 106,767

Smart money looks at. Are you? pic.twitter.com/gwjt8cr7s9– Arslan Ali (@Forex_erslan) June 4, 2025

Smart Money places suspension orders directly at the bottom of the last price at $ 104,098 with a calculated margin which allows the departure of the agreement quickly in the event of waiting is not correct, while maintaining an appropriate distance to avoid early output due to fluctuations from the natural market.

And with the companies entering the place – like Sber, which has launched bitcoin and strategy obligations (the new name of Microstrategy), which has collected additional $ 250 million to buy BTC – it seems that the main scene confirms what the graphic plans do not suggest: perhaps the next emerging step of the Bitcoin price is closer to many people.

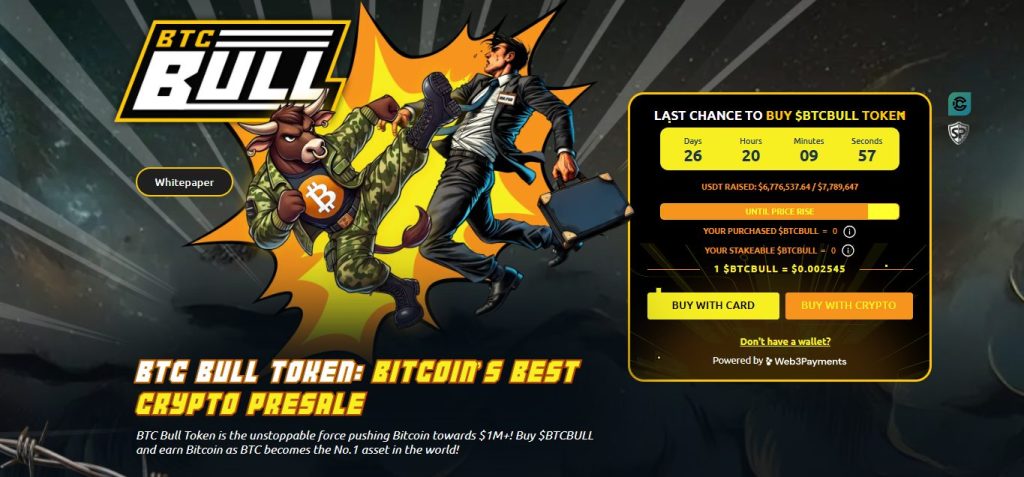

The fascinating mortgage turnover of 61% ignites the demand and pays the outcome of BTC Bull to approach $ 7.8 million

The BTC / USD pair exchanging nearly $ 105,000, the concentration of investors quickly turns to alternative currencies, in particular BTC Bull (BTCBLL). Until his date, he raised $ 6,772,528.93 on the current stage of the current stage of $ 7,789,647, with more than a million dollars before the next price increase.

Bitcoin Rewards and a successive reduction in the offer

The innovative BTC Bull model depends on the connection of the rewards directly to the price of bitcoin, and the following is an explanation of its operation:

- Free Bitcoin distributions: The owners of BTCLL obtain BTC bonuses, where participants in the subscription are granted a distribution priority.

- Reduce food: The BTCBull offer is burned the $ 50,000, which reduces the total offer and supports the price of the currency.

- The current price: $ 0.002,545, and it should increase as the subscription is approaching its targeted financing.

This method combines flexible rewards and the integrated scarf to make the BTCBull value perfectly consistent with the performance of the Bitcoin Prize.

A mortgage complex with an annual yield of 61% without reservation periods

The BTC Bull mortgage complex offers the opportunity to earn an annual return of 61%, because the number of currencies mortgaged within the framework of it reached 1,731 936 103 BTCBLL. The main advantages include the following elements:

- Unite Reservation costs or periods: Investors can freely enter and get out of the mortgage complex without being subject to fines or costs.

- Complete liquidity: The possibility of withdrawing funds at any time without joining the reservation periods, as is the case in most traditional decentralized financing projects.

- Fixed feedback: BTCBull owners gain uniformly income regardless of the market conditions.

This model attracts veteran investors to the world of decentralized financing, and new expatriates in search of enriching returns without going in complicated conditions.

A strong momentum in preparation to achieve the target result

Participants rush to buy BTCBull with less than a million dollars to collect it during the final subscription stages, and the work mechanisms of the project – rewards linked to the launch of Bitcoin and the gradual reduction of supply via the burning mechanism to distinguished mortgage options – contribute to stimulating participation. The subscription offers the possibility of entering before the next price height, in particular with the fluctuations in Bitcoin prices.

The most important data:

- The result of the subscription: 6,772,528.93 of $ 7,789,647

- The current price: $ 0.002545

- Mortgage complex: 1.73 billion BTCBull

- Annual mortgage reports: Almost 61%

The innovative BTCBLL model continues to attract the attention of investors while the subscription quickly approaches the final financing objective, and this moment represents a last opportunity to buy the currency at the current price before its subsequent increase.

The post of the triangle model Pressures on the price of Bitcoin at $ 105,000: three technical indicators announce an imminent increase of 6% appeared first on Arab Cryptonews.