Pump Fun Token debuts in the main exchanges, but the price sinks 21%: does a recovery come?

The long -awaited FUN FUN PUMPING TOKEN He made a high profile debut this week, live in the best exchanges, including Kraken, Kucoin, Bybit, Gate.io and OKX. Despite the intense exaggeration and the aggressive deployment designed to capture global cryptography attention, the price of Token took an unexpected fall, leaving merchants questioning whether the fall indicates a momentary correction or a deeper problem within the impulse of the project.

As the dust sits, market observers and retail investors are carefully studying the lists, looking for clarity about what comes next for this very prominent memory and what its first volatile days reveal on the dynamics of the broader cryptographic market.

|

| Source: x |

A coordinated exchange debut designed for maximum liquidity

Fun Fun’s strategy was clear from the beginning: global visibility and immediate liquidity. The launch was almost simultaneously in multiple top -level trade platforms:

-

Kraken: He enabled the spot trade and margin from the launch.

-

Kucoin: Accepted deposits for SPL Solana wallets along with the USDT trade.

-

MEXC: Usdt and USDC pairs were added.

-

Gate.io: I was live with commerce at 5:00 p.m. UTC along with a promotional campaign of Candydrop.

-

OKX: He opened the trade of perpetual futures at 17:30 UTC, adding leverage exposure options for merchants.

-

Bitget: Fully enabled deposits and the spot trade from day one.

This broad and aggressive strategy worked. The Token captured significant global attention, with new listings attracting in a wide range of merchants, from retail enthusiastic to high frequency futures players eager to capitalize volatility.

Why was the price of Fun Fun Fun immediately after launch?

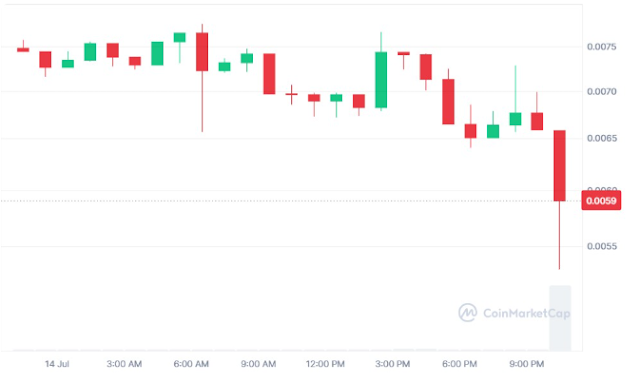

Despite a seemingly perfect launch strategy, the price of Token failed to maintain its early impulse. According to Coinmarketcap data, The pump fun fell 21.16% on the first dayfalling to approximately $ 0.005902. For many merchants, this strong decrease raised immediate concerns about whether token’s exaggeration was justified.

But the explanation can be simpler than panic implies. Many early participants in public sale and rounds prior to launch received immediate unlocks, giving them the freedom to sell as soon as trade began. The rapid influx of sales orders created significant descending pressureA scenario often witnessed with newly launched tokens, especially those who travel in exaggeration prior to the launch within the Memecoin category.

The negotiation volume increases more than 2500% despite the price drop

While the price fell, the negotiation volume moved in the opposite direction. The volume of fun fun increased 2567% in a single dayreaching $ 163,08 million. This spike indicates a crucial element: Market activity is still robust Despite the recoil of prices.

Token market capitalization remains about $ 2.08 billion, backed by a large exchange of futures on platforms such as OKX and Bybit, where merchants actively bet on movements up and down. The combination of high liquidity and a strong user participation suggests that, despite the initial price correction, the pump fun retains significant attention from cryptographic merchants.

Understand the sale of the sale: a normal phase after launch?

Experienced cryptographic analysts emphasize that sales of subsequent sales to the large -scale list are not unusual. Many merchants and first buyers aim to obtain immediate profits, especially in the highly speculative memecoin market.

This phase often represents a trial terrain For the long -term viability of Token instead of a verdict about its potential. If the token can maintain the participation of the community, execute deliverables with promised roadmap and continue with the growth of the platform, the sale of sales can simply be a new temporal test before a more stable price discovery phase.

Pumping pricing prediction: what could happen next?

Using the analysis in the chain and the current impulse of the market, here is a realistic projection for possible Pump Fun price movements:

In the short term (1–7 days):

The Token can re -test the lowest support levels about $ 0.005 or dive slightly below, but if it is maintained above $ 0.0048, there is the potential of a bounce around $ 0.0064. The commercial interest of futures and leverage long positions could accelerate a rapid recovery.

In the middle of the period (2–4 weeks):

Campaigns such as Bybit Rewards, OKX Futures Incentives and Candydrop de Gate.io can maintain interest, which can boost the price at $ 0.007– $ 0.008 if the broader market conditions remain favorable.

In the long term (3–6 months):

If the Pump Fun ecosystem demonstrates real growth and attracts a significant adoption of users, especially with the possibility of a future binance list, the price could point to the range of $ 0.010 – $ 0.012. However, the risks such as the saturation of memecoras and the changing feeling of the merchant could challenge the ascending impulse.

Factors that influence the future of Bump Fun

Several factors will play a crucial role in determining whether the pump fun can maintain and build on its early exaggeration:

-

Exchange support: The liquidity and continuous exposure in the main exchanges will be vital.

-

Community Commitment: A strong and active community can provide resilience against market volatility.

-

Usefulness of the platform: If you pump funny it transforms pure speculation to offer real utility within its platform, it will improve its value proposition.

-

Market feeling: The feeling of the cryptographic market remains highly sensitive, and the broader trends will affect short -term price movements.

Conclusion: A rocky beginning, but far from finishing

The launch of Pump Fun exemplifies the volatility that defines the encryption market, especially for tokens driven by community exaggeration and speculative energy. Yes, the initial price drop could worry about some, but the underlying commercial volume and market activity indicate continuous interest.

The generalized listings of the token, the solid liquidity and the strong buzz of the initial community indicate that the project still has potential, provided that it can turn short -term attention into long -term growth. If the recent fall was simply a dip before the next rally or an early sign of Overhype will depend on the next weeks of commercial activity and ecosystem updates.

For now, the market is observing closely, and the fun tab of the pump remains firmly in the radar for merchants seeking volatility and upward potential in the dynamic cryptographic environment of 2025.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.