Tuhar’s record profits show an evolution towards traditional financing systems because it aspires to launch a new product in the United States; The giant company for the issue of stable currencies has become one of the largest investors in American public debt, after having given fixed income and organizational acceptance to the detriment of speculation gains.

Main points:

- The USDT and its user basis have been a lot after having recorded 46 million new portfolio addresses, to strengthen the liquidity of the company and its domination in the stable currency sector.

- Strategic investments and new organizational supervision in Salvador refer to the effort of Tuhenthar to enjoy global credibility and develop beyond the simple issue of stable currencies.

TETHER, the largest stable currency issue company, announced the realization of operating profits exceeding a billion dollars for the first quarter of the year 2025, driven by its solid yields for its US treasury obligations, because the company’s latest financial reports – which have been prepared by BDO International COMPTINGING – revealed that the total value of its possession of the American treasure 120 billion people, which lives up to Treasur Date.

The high profits of Tuhar thanks to the gains of the bonds of the Treasury and the increase in the number of USDT governors by approximately 46 million additional portfolios

The report of the financial statements from the first quarter until March 31 confirmed that the company had followed a conservative strategy concerning its parallel reservations and its continuous domination of the stable currency sector, because the majority of the benefits of the company have gone through traditional investments, in particular its investments in the bonds of the Treasury, while the good performance of gold compensates for the fluctuations of its digital assets.

The attachment to the approach of $ 120 billion in US Treasury bills, confirms the quarterly opening profit of more than $ 1 billion and strengthens USD global demand in T1 2025

Read more: https://t.co/u43rj6bwwc– Tether (@tether_to) May 1, 2025

The value of the total asset of Thanihar amounted to approximately $ 149.3 billion for the obligations (exported assets) with a value of around 143.7 billion dollars, which are all almost the supply of its stable currencies, because the report confirmed that Tuhar’s assets have exceeded their obligations.

The offer of stable currency, the USDT, has increased a lot in the first quarter, to increase its display by around 7 billion currencies, accompanied by a construction of around 46 million new portfolios, an increase of 13% compared to the previous quarter. In addition to its main financial activities, the company continued its pursuit of strategic investments thanks to its investment branch.

Although it is outside the parallel reserves of USDT offers, investments worth more than $ 2 billion have been directed to long -term initiatives in the fields of renewable energies, artificial intelligence and direct contacts of the counterpart to isotope (P2P) and data infrastructure.

Likewise, the first quarter of 2025 attended the first period of USDT’s subjugation at official organizational supervision in Salvador after the company recently obtained a license as an export point for stable currencies in the legislative framework of the country’s digital assets, as part of the creation of its credibility on traditional and emerging markets; Paolo Ardoino, CEO of Tithar, said that “the first quarter of 2025 showed the continuation of the Société de Triger for stability, power and vision,” said Paolo Ardodino, CEO of Tithar -.

TETHER is only the certificate of the first quarter of 2025, the first quarter under regulatory supervision in Salvador.

Protective facts on March 31, 2025:

* 143.6B Total ISSTED USDT.

* 149.3B Total assets / reserves.

* 5.6B Reserve Excel, in addition to reserves at 100% of liquid assets … pic.twitter.com/riovi31qx– Paolo Ardoino (@Paoloardoino) May 1, 2025

Tuhar is looking to develop in the United States

After having made solid profits for the first quarter for the financial year, for an amount of $ 1 billion and increased the obligations of the US Treasury, Thanha is currently focusing on the issue of a stable currency for the United States; In an interview held on April 30 with CNBC, Erdino – CEO – revealed the company’s desire to launch a new product designed for the American market, perhaps before the end of 2025.

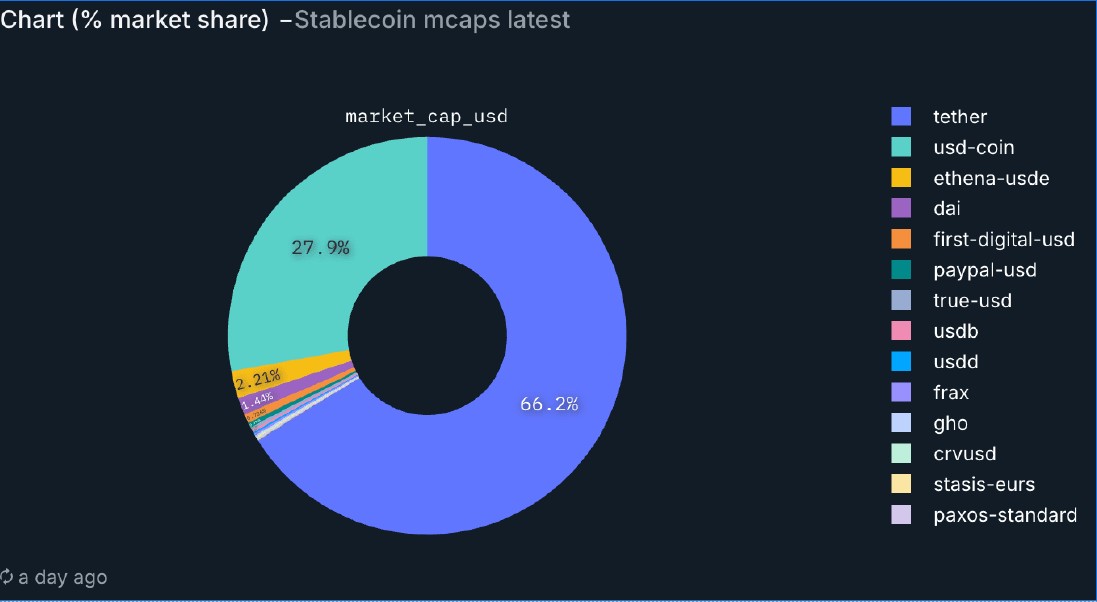

According to the Nansen report, the USDT – which is currently issued by the company Tithar – dominates the stable currency sector worldwide with a market value of around $ 150 billion and a market share of around 66%. However, despite this hegemony, the adoption of the USDT in the United States has remained very limited, with a stable counterpart from its circle with a more spacious user.

While Erdino Explained the Trend of the Tayar Company Towards Cooperation Actively with the American Regulatory and Legislative Bodies to Draft the Upcoming Legal Legislation For Stable Currencies, as well as the Company Undergoing Independent Connection by one of the 4 Large International Care Transparency, The Company Described ITS Product (USDT) AS The Digital Extension of the US Dollar Currency (USD), Especially in the Foreign Markets That Lack Services, but it is, it is that it is currently looking to repeat the same internal approach.

Follow us via Google News

The Post Tether file records the profits in the first quarter of a billion dollars after the number of its governor increased by around 46 million and its bet to a value of $ 120 billion on the US Treasury bonds appeared first on Arab Cryptonews.