Paolo Ardoino, CEO of Tether, announced that three pioneering companies of Toyota, Bayd and Yamaha companies began to accept the USDT part in the payment options in Bolivia.

The announcement by Erdino of this achievement came in an article on the X platform on September 21, in which he declared that the USDT was a “USDT).Digital dollar“Which is currently used hundreds of millions of people, especially in developing economies.

Toyota, byd, Yamaha accepting usdt in Bolivia

"You vehicle in digital dolares"

The USDT is the digital dollar for hundreds of millions on the markets emerges.

UBIQUITY. pic.twitter.com/0x0sh3usxx– Paolo Ardoino (@Paoloardoino) September 21, 2025

Advertising of the accreditation of stable currency (USDT) is a means of payment at a time when the Bolivian central bank (BCB) recorded the volumes of payment transactions using digital currencies of 294 million dollars in the first six months of 2025, an increase of 630% on $ 46.5 million recorded in 2024.

“Dollar digital” strategy and how to start using USDT in Bolivia

This expansion came in the context of the Bolivian decision issued on June 25 to cancel the ban on digital currencies, which gave the “virtual assets” and allowed financial institutions to lead customer transactions to Carto platforms.

ASFI, the financial regulation body in Bolivia, said that the decision has enabled the country to facilitate CRIPTO transactions in an organized framework.

It should be noted that Bolivia has expanded the use of digital currencies in the public sector on March 13 when Yuis ARCE has enabled YPFB to carry out crude oil imports using American dollar currency (USD) or digital currencies.

From October 2024, Paulifi Boliva Bank launched the Static Conservation Services of the company Tetar (TETHER) in order to provide the possibility of negotiating customers, and the Bolivian central bank recently signed a memorandum for understanding the national authority of digital assets in El Salvador in order to improve the development of the digital asset sector, to consider as “as a” traditional Curgence.

In general, Latin America witnesses a boom in the adoption of payment activities using digital currencies, because the recent regional analysis of the Crapto Bitso has revealed that economic instability and low local official currencies across Latin America have converted stable currencies such as USD Coin-USDC and basic tool attachment to conserve value.

The inflation crisis triggers the accreditation of stable currencies in Latin America

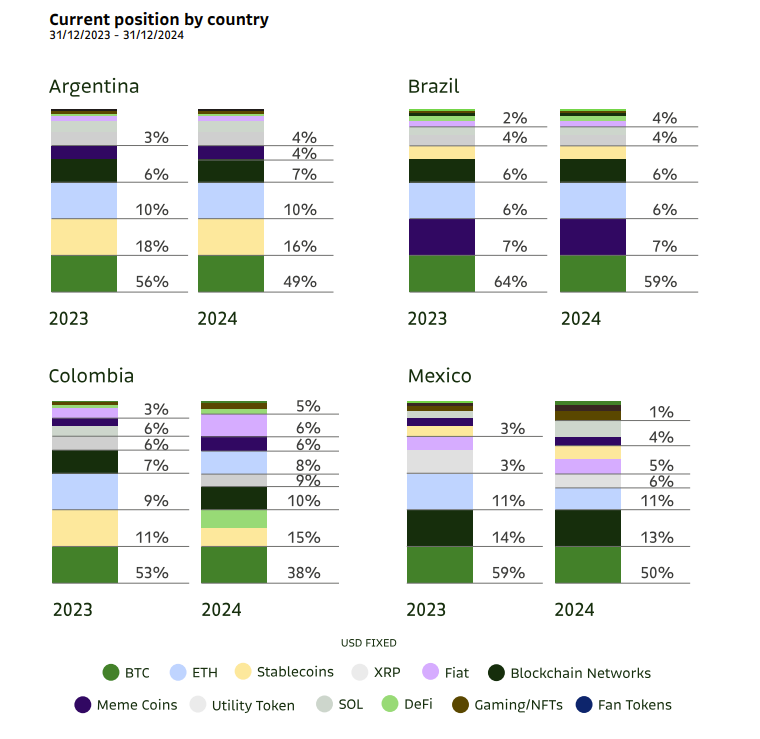

Argentina – which suffers from inflation exceeding 100% – uses stable currencies as one of the forms of financial fluctuations, and Brazil has maintained continuous expansion thanks to the clarity of regulatory laws and flexibility of the technological sector, and the adoption of these digital currencies increased by 6% after the registration of 1.9 million users, as stable currencies These transactions.

While Columbon Investors relied on stable currencies after confronting the restrictions linked to banking services linked to US dollars, Mexico maintains its regional leadership in the Cripto sector, where Bitcoin-BTC and the USDT (USDT) dominate international transfers in the midst of the low value of the official currency of Bizo of approximately 23%.

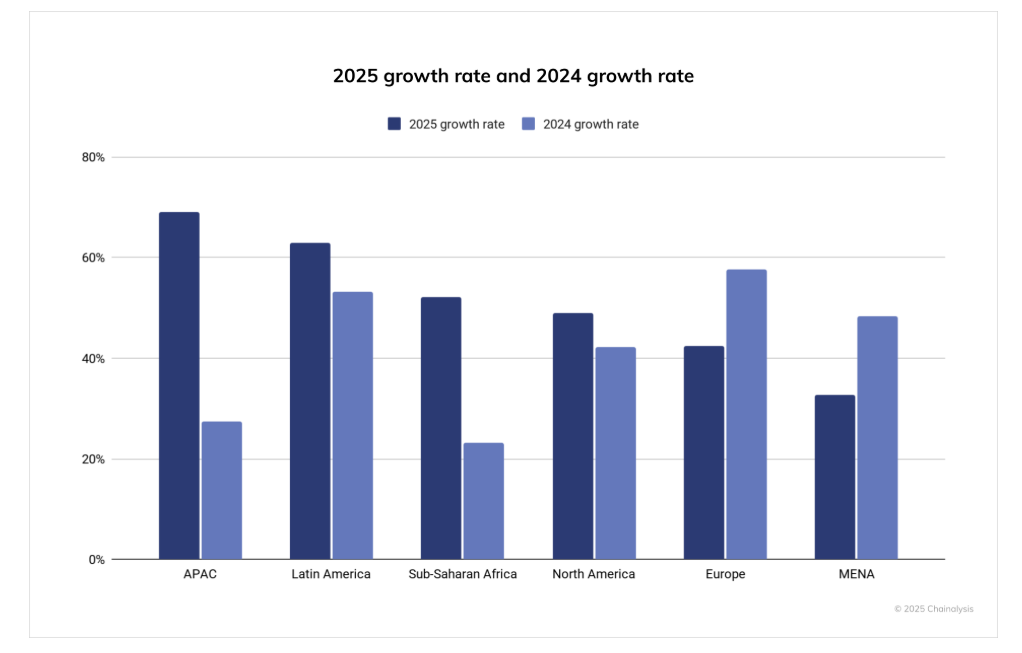

Regional data also confirms the growing orientation of the increase in accreditation, as the last “Chaiinalysis index to adopt chipto assets” revealed that the adoption of digital currencies in Latin America has increased from 53% in 2024 to 63% on an annual basis, which improves the position of the region to one of the faster digital currencies.

It is indicated that the Latin American acquisition of 9.1% of the world value of digital currency transactions between July 2023 and June 2024, because this region carried out transactions using digital assets of around $ 415 billion during this period.

This growth also appears through the classification of countries, because three countries in Latin America have reached centers among the other 20 countries according to the digital assets of 2025, which are Brazil (fifth), Venezuela (eighteenth) and Argentina (twenty).

Mariela Baldivieso – The Bolivian Parliament for the Cydaana Commonad Party – said that the complete adoption of digital currencies can improve the economic pillars of the region, noting that the adoption levels of Bolivia of digital assets are currently among the five largest countries in Latin America shared in this area, thanks to the policy of progressive reforms that follow it.

¡A Gran Paso Para La adopción de criptoactivos in Bolivia!

A party from East of the Toners 28 of Octbre, Estará replied a Nuevo Servicio de Gardodia, Compra there Venta de Usdt. Esto represented a significant advance hacia the integración of criptomonedas en el. pic.twitter.com/a7zzhsn0c0– Mariela Baldivieso (@Baldmarila) October 27, 2024

It should be noted that Toyota has extended the payment options to include acceptance of the USDT as payment in Bolivia is not the first time that the company has been involved in paying a blockchain and digital currency list.

In July 2024, the Blockchain Toyota laboratory provided for the MOA factor (mobility account) according to the ERC-4337 standard on Ethereum blockchain in order to grant vehicles on the blockchain which supports complete self-operation.

Later, the Toyota Financial Affairs Department announced its intention to publish digitally financial obligations on blockchain (known as ST bonds), and these obligations in the Toyota portfolio allow exclusive privileges for their holders who also enjoy membership in the Toyota portfolio.

The CEO of the Post de Tether confirms the acceptance of Toyota, byd (byd) and Yamaha (Tether-USDT) as payment of payment calls on Cryptonews Arab.