The price of the Solana currency increased by 10.9% this week, the resistance level laboratory, $ 179, and the cut and the handle set a price target at $ 295, coinciding with the high total value reserved in the Bluea Blocchain of Solana Blockchain at 9 billion dollars.

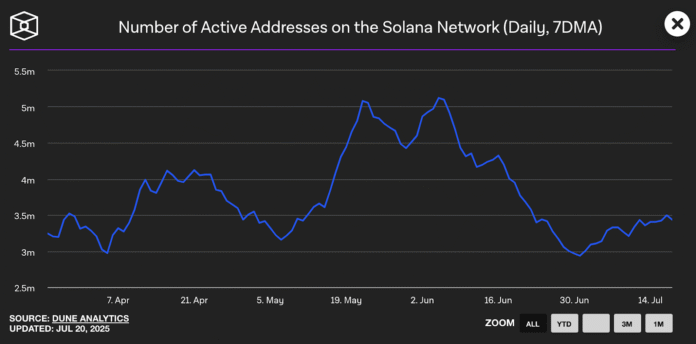

The price of the Solana currency increased by 10.9% this week, benefiting from the general recovery observed on the crack market to test the decisive resistance levels around $ 179, and this increase coincided with the improvement of its blockchain network data, including the increase in the total value seized (TVL) of $ 6 billion to more than $ 9 billion, while Number of active portfolios users exceeded users of 33 million.

The technical analysis of the performance of the Solana currency (Solana) reveals its fighting battle between the decline areas and the height, because it currently tests the point of balance around $ 179, knowing that it has witnessed stability relatively in the last weeks in a range of $ 145 and $ 175, while its last movement suggests that this stability will soon be launching in the higher direction.

In addition, price behavior changes during the months of March and Nissan reflect the possibility of reflection in the direction, followed by a clear change in the general market direction, which confirms the existence of high demand at low levels.

As for the long term, the graphic diagram shows the shape of a cup and the handle which extends for several years, allowing the price to rise to the highest level of $ 295.

$ 189 test as a penetration area

The Solana currency performance plan shows the 4 -hour chronology tested by the upper limit of the equilibrium area, and the main resistance of $ 189 represents a decisive level of the ascending direction.

In addition, its trading volume analysis is likely to have a solid support base around the level of $ 145, because it is clear from the nodes of huge sizes, and the low volume of trading higher than the current levels can open the way to quick movements if the resistance barrier is hacked.

In light of the Federal Reserve, the cessation of current interest rates and the increase in expectations of their reduction of around 30 to 50 base points in the last quarter of this year, a favorable environment for very volatile assets such as Solana.

After entering the level of $ 189, the price will target resistance levels at $ 235 and $ 263, analysts expected the price objectives to extend at levels of $ 295, $ 360 and $ 402 supported by basic factors that include solid developer indicators and institutional partnerships.

The cup and sleeve model on the weekly graphic graphic indicates the targeting of the $ 295 level

The weekly graphic plan for the performance of the Solana currency (Solana) shows the formation of the movement of a cup and the handle over several years, and it is one of the strongest models of technical analysis.

$ Soil Weekly update of Solana

Massive cup and handle forming on the weekly deadline

A new ATH will put this away 295pic.twitter.com/lvkascu4jg

– CJ (@Cjscalls) July 19, 2025

According to this analysis, the Partial CUP started from the summit recorded by the price at $ 260, followed by a circular background between $ 80 and $ 20 by making a high level of support, after which a recovery wave began to form a traditional assembly area.

It seems that the price of Solana’s part currently draws the handle in its slight decrease compared to the edge of the cut, because this final stability stage of relative stability precedes the net heights to complete this increasing technical model which indicates the possibility of targeting the price level of $ 295, to record – later – an unprecedented increase according to the depth of the cut and the starting distance in relation to the penetration point.

In addition, the world rate of availability of liquidity is improved by the monetary facilitation policy coordinated by central banks – or what is called the “second wave of liquidity” – in the interest of digital currencies, and also creates developments related to the clarity of the organizational scene – such as Genius – a favorable environment for the allocation of alternative monnais with the appropriate artistic price Approaching Currency (Solalane).

Snator-Snort subscription

Snator’s subscription was incredible because more than $ 2.1 million collected investors awaiting Solana’s next stage. With its official launch approaching in the third quarter of 2025, the opportunity to join the SNOT room is reduced, and investors interested in the project can move quickly to acquire it at its current price.

It is possible for owners Snorter density Taking advantage of several sources to obtain yields thanks to the technical system of his project, where the first investors can obtain an annual mortgage (APY) up to 186%, as well as to benefit from negotiation costs of 0.85%, which is much lower compared to competing robots of the Solana blockchain.

In addition, Snorrer will have the voting rights on future decisions of the independent decentralized organization (DAO) and early access to new currency launchers on the platform. In addition, the economic data of money is designed in a way that is pushed to maintain it in the long term thanks to mortgage mechanisms which support the growth of the platform at the same time.

While the price of the Solana currency approaches its potential objective at $ 295, it will be in the interest of its alternatives that demand increases accordingly, because market expectations indicate that the price of a currency indicates Snor It can reach $ 0.65 by the end of 2025, led by the increase in the adoption of professional currencies and the expansion of the Solana technical system.

In all, the approach to the end of the subscription period and the date of the currency launches the rare element that the first investors benefited from other successful infrastructure projects.

The expectations of the solara-sola currency prices with an increase of 10.9% this week; Can it penetrate the level of $ 185? APPLERDIRST on Arab Cryptonews.