Bitcoin-BTC-The largest digital currency swing in the world above $ 95,832, in reference to Bitcoin resilience after having temporarily decreased in the Fibonacci correction level 0.5 to 95,444 $. Although its price has decreased by 0.52% in the past 24 hours, it is still up 1.71% in a week; Its last height confirmed at the level of $ 97,754 that the BTC momentum did not completely disappear.

The technical indicators show the cohesion of the price of bitcoin above the average average movement of if in 50 days (50 EMA) at $ 94,971, and above the support area at $ 94,872. In addition, the convergence of these indicators represents a solid base for the price, and any height greater than it will pay at the price of approximately 96,782 and $ 97,329.

On the other hand, the ablution of the MacD index in a descending area, but low trading sizes indicate that this descending momentum will not always be, and the price could increase again as soon as buyers return.

Suggested trading strategy

- Entrance point: While waiting for a safe height above the level of $ 95,444.

- Price objectives: $ 96,782 at $ 97,329.

- Loss of stop: Down $ 94,870.

Institutional investment currently holds 9% of Bitcoin parts, which supports their price

Some people may wonder why bitcoin retains its position despite all these fluctuations, and the response is institutional demand, because the data indicate the blockchain that the institutions have Almost 9% Total Bitcoin supplies, including senior players such as Blackrock and Fidelity. Their investments in the Stock Exchange Stock Exchange (ETF) have contributed to a new minimum price.

9% of the total #BTC The offer is now held by #Bitcoin ETF and public companies.

Let it sink. pic.twitter.com/bgd0fmpdj– Crypto Decode (@thecryptodecode) May 4, 2025

This ETF offers easier access to Bitcoin, in particular for senior players in the financial sector, which contributes to reducing market fluctuations. Unlike short -term merchants, institutions tend to keep assets for very long periods, which reduces their offers and adds pressure on their price over time.

A look at institutional influence:

- Blackrock and the Federation appear at the forefront of investments received at the Stock Exchange (ETF).

- Easy access to boxes circulating on the stock market reduces the sales pressure.

- Keep the currency in the long term reduces its offer and helps stabilize prices.

This change reflects what is usually happening in traditional markets, where the investment subject to regulations leads to large fixed investments.

The global expansion in the field of Chipto provides long -term support. Will the price of Bitcoin increase?

BINANCE – The largest digital currency trading platform in the world – is to increase the adoption of Bitcoin by holding global partnerships. A recent agreement with the Kyrgyzstan Investment Agency led to the Binance Pay Service and the Blockchain Education Programs in the region. This is an initiative that has the support of President Sadeyr Japarov, by which Bings aims to create a national infrastructure for Caribto.

Binance to launch cryptographic payments in Kyrgyzstan with a new partnership pic.twitter.com/y3oultd125

– Crypto xplosive (@cryptoxplosive) May 4, 2025

Meanwhile, Bennes provides consultations to other countries such as Pakistan on Chipo policies, which increases the legitimacy of digital assets in emerging markets. All these developments improve the propagation of Bitcoin and their uses, especially in countries with less developed banking systems.

The main points related to adoption:

- Kyrgyzstan will launch Binance Pay and teach Chipo.

- Pakistan plans to approve the regulatory laws of digital assets with the help of dumpsters.

- These developments improve the use of bitcoin in the real world and increase their trading sizes.

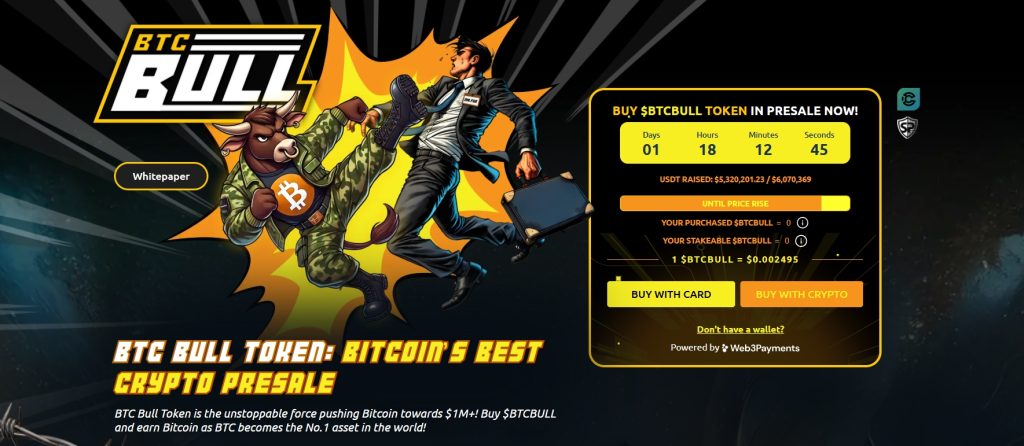

The result of BTC Bull is more than $ 5.3 million thanks to flexible mortgage income attractive of 78%

BTC Bull (BTCBLL) continues to draw the attention of many after its result exceeded $ 5.3 million, approaching its target of $ 6.07 million. With the low price of $ 0.00249, BTCBLL has turned to become more than a simple MIM, due to its supply of various practical uses thanks to a flexible mortgage mechanism which offers the possibility of gaining exciting yields.

High demand thanks to economic data derived from employment uses

Unlike traditional MC currencies, BTCBull has managed to mix the attractiveness of MG currencies with concrete mortgage yields; It allows its investors to be currently subject to their assets purchased and to benefit from an annual mortgage (APY) of 78%, while retaining the possibility of canceling its mortgage when you want to do it without fines or periods of crisis, to attract a mortgage mechanism from the interest of many investors who wish to obtain a return without sacrificing the Crapeto markets for fluctuations.

Current subscription data:

- The result of the subscription: 5,337,631.36 $ on 6,070,369 $.

- The current price: $ 0.002,495.

- Total mortgage complex: 1 362 485 477 BTCBULL.

- The estimated return: 77% per year.

Currently, the subscription is close to its end with the need to collect less than $ 680,000 before the start of its next phase, which means limited time for those looking for a currency that provides high yields and unprecedented mortgage elasticity, because BTCBUL is preparing to become a solid competitor during the exciting CRAPTO cycle of 2025.

Follow us via Google News

The price of Bitcoin is $ 95,832: does this indicate a renewed bull activity after the appearance of the recovery panels? APPLERDIRST on Arab Cryptonews.