Ethereum-Eth is displayed on trading platforms at its lowest levels in 8 years, while Blackrock bought $ 570 million in a decision that triggered expectations that this decrease could represent the last buying opportunity before the price of around $ 4,000.

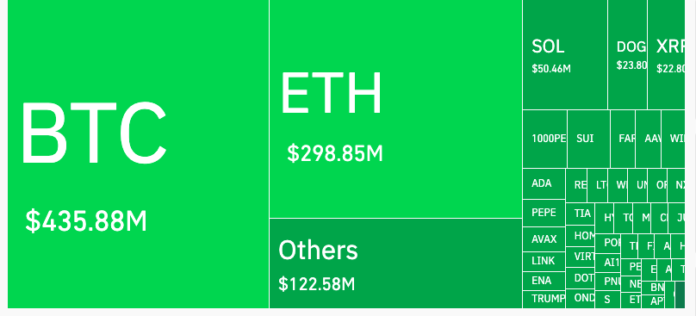

Ethereum Price decreased by 9% on Friday morning, causing a vague qualification of around 298 million dollars and extended more than 80,000 merchants. Despite the low -based sales wave, Smart Investments took the opportunity to buy when the price drops below $ 2,500. This drop coincided with a wave of corrections that spread the market, because the price of the ETH increased from $ 2,771 to $ 2,443 before paying around $ 2,509.

On the other hand, fears of the trade war sparked this drop, but intelligent investors considered it a window appropriate for the purchase.

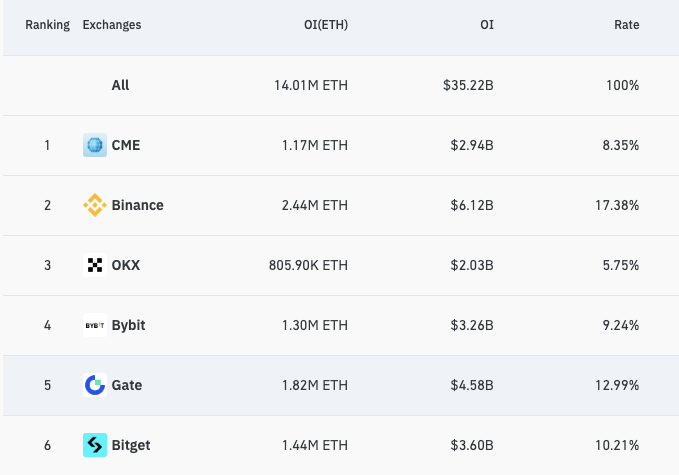

A strong increase in the size of open contracts for Ethereum to 35.22 billion dollars: Black Rock and new investments entering opportunities during the decrease

Despite the pressure of the sale, the total volume of contracts open for floors has increased to $ 35.22 billion in the past 24 hours, and the main platforms – including the Chicago commercial stock market (CME), Binance, Bitget and Porte – are the highest levels of activity, as the average value of operations open on Ethereum has around $ 4 billion.

The market is witnessing new investments in conjunction with the high volume of open offers, indicating the possibility of the current trend with the growing number of traders who open up new offers or widen their existing transactions. One of the whales of the Ethereum currency recently opened a speculative agreement at a price of $ 16.6 million, in a decision which reflects strong confidence in alternative currency despite market fluctuations.

With this drop, investment establishments continue to buy Ethereum without decline, and Black Rock – the largest asset management company in the world in the world with goods of more than $ 73 billion in digital currencies – continues to buy Ethereum per day for more than two consecutive weeks.

Just inside:

Blackrock buys Ethereum every day for two weeks

They now have $ 570 million in work in $ ETh

Smart Money does not slow download, they double the download pic.twitter.com/powikxtkhq– Jeremy (@jeremybtc) June 13, 2025

In the past 14 days, the traditional financing giant has collected ETH worth around 570 million dollars, because data from the Arkham intelligence platform indicate that the company now has more than 1.5 million ETH, worth $ 3.83 billion, according to current market prices.

In a simultaneous step, Sharplink Gaming recently acquired 176,271 Ethereum currencies worth $ 463 million, becoming the largest foreign exchange owner among the stock market companies on the Stock Exchange.

Historical standard: 29 consecutive days of investments received in Etheerium funds traveling on the stock market in the middle of the growing adoption of decentralized financing solutions

The investments received in the immediate negotiation funds of Ethereum on the Stock Exchange did not stop for 29 days, which is the longest positive period since its launch, because the adoption of the financial institutions of the currency is accelerated with the approach of the American commission for securities and the exchange to the adoption of a more open position towards the financing of the decentralized platform (DEFI) and the adoption of the platform of the platform of the platform for the financing of the platform.

Meanwhile, Eterium’s offer on trading platforms has decreased to its lowest level in 8 years, which can increase their price quickly. Many Chipo investors believe that these factors prepare the price of ETH to enter the $ 4,000 barrier at the end of 2025, while CLS Global – of the main market decision -makers – shows more optimistic expectations than the price of ETH has reached $ 5,400 in the short term and $ 7,000 by 2027, with a perceptible increase compared to current levels.

$ ETh/ USD analysis:

Doubled from $ 1.4,000 to $ 2.8,000 in 2 months. What is the next step?Key points:

– Momntum strong with a weakening of the pressure of the sculpture

Local target: $ 5.4,000 possible continuation

– Long -term view: probably linked to the beach from $ 2,000 to 7,000 years for the next 2 years

– Currently test resolution at … pic.twitter.com/h8qbwqout4– CLS Global (@coinlique) June 11, 2025

A test of $ 2,500 represents a decisive point which defines the next direction of the price Ethereum

The daily graphics plan for Etheerium is revealed in a large fork between $ 2,300 and 2,700, because the price is currently testing the minimum of this range, because the currency experienced a high price start at the end of 2024, from around $ 1,800 to around $ 2,900, before entering the current relative stability phase.

The recent decline paid Ethereum to test the main level of support in this beach, especially in the $ 2,500 to 2,550.

This level represents a decisive point, because it is clearly broken, it can end the current transverse trading movement, and the price can decrease to around $ 2,300 or until the significant level of support is tested at $ 2,000. If the price maintains the current support, it can target $ 2,700 – which is the upper limit of the last price range – and it can reach $ 2,800 if the positive momentum continues.

The Post Ethereum price is 9%, but Black Rock invests $ 570 million. Does the price run about $ 4,000? APPLERDIRST on Arab Cryptonews.