The new Trump blitz sparks global nerves and cryptographic talks

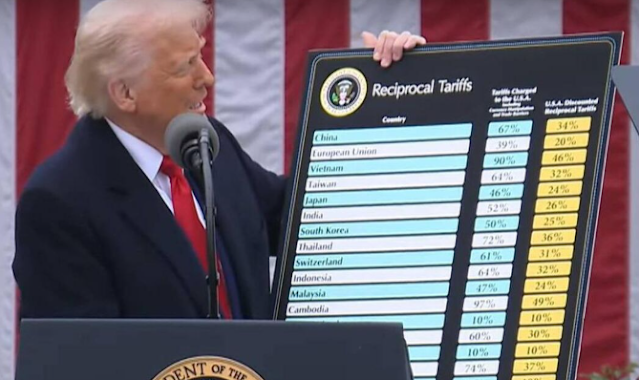

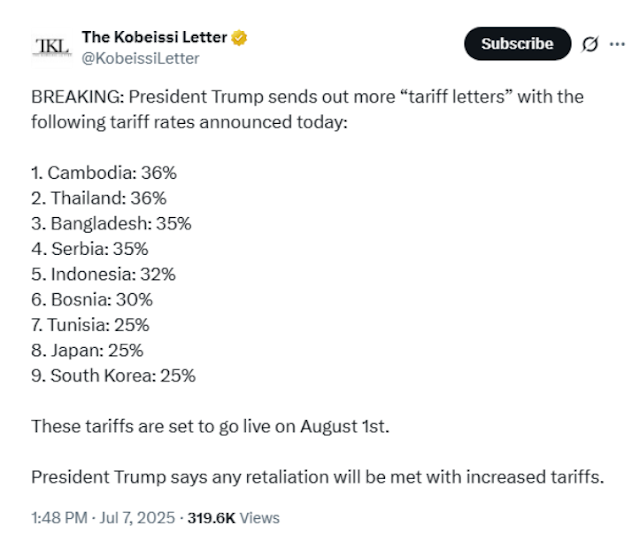

President Donald Trump’s last tariff save is undulating through diplomatic circles, global markets and the cryptocurrency community. The administration has issued letters to 14 countries that detail new steep taxes that take effect on August 1, warning that any reprisal movement will be fulfilled with more increases. The aggressive position underlines the lasting agenda of “America First” of Trump while seeking to consolidate his legacy of post -election policy while lighting concerns about commercial wars, the volatility of the currency and the emerging role of Crypto as a hedge against geopolitical tensions.

Why the announcement now?

The time of the announcement has raised the eyebrows, even when negotiations with key commercial partners such as Japan are still ongoing. Analysts see the movement as a pressure tactic, taking advantage of the threat of tariffs to extract faster concessions.

|

| Source: x |

For Trump, tariffs are more than an economic maneuver; They are a strategic signal of force for their voting base, which demonstrates a hard position in foreign trade as the approach to the consolidation of power and reinforcing national economic narratives.

Countries in the sights: Who faces new tariffs?

Administration’s letters described the following tariff increases:

-

Myanmar, Laos: 40% of tariffs on specific imports

-

Thailand, Cambodia: 36% of tariffs

-

Bangladesh, Serbia: 35% of tariffs

-

Indonesia: 32% of rates

-

South Africa, Bosnia and Herzegovina: 30% rates

-

Malaysia, Tunisia, Japan, Kazakhstan, South Korea: 25% rates

These walks are mainly directed to electronics, manufacturing and car parts, with nations such as Japan and South Korea to reinforce economic interruptions that could be cooked through their supply chains.

|

| Source: x |

The political and economic strategy behind Trump’s tariffs

The Trump approach aligns with its long -standing position on reciprocal tariffs and deficit reduction. The White House hopes to use these tariffs as leverage to push commercial partners to more favorable agreements, with the aim of protecting national industries while reducing the United States dependence on foreign supply chains.

With the completed electoral cycle, Trump is looking to block his policy agenda, appealing to supporters who favor a hard line approach for trade and globalization. The administration’s message is clear: the United States will no longer tolerate what it perceives as unfair commercial practices, and is willing to increase tensions to ensure better terms.

Market reactions: actions and crypto see volatility

Global markets quickly reacted to rates news:

-

Dow Jones: 577 points fell (-1.29%)

-

S&P 500: 67.81 points fell (-1.08%)

-

Nasdaq: Decreased 241.22 points (-1.17%)

The cryptocurrency market also faced a strong correction, with the total capitalization of the cryptocurrency cryptocus that decreased 4.2%, sliding below the support level of $ 3.50 billion to pass the rhythm of $ 3.41 billion in 24 hours.

Investors are weighing the possible undulation effects of retaliation rates and commercial restrictions, with fear of a prolonged economic friction that cushions short -term feeling through basic actions and products.

What global merchants should see below

Market observers anticipate the reprisal movements of the affected nations, potentially in the form of counter-tarifa or new import restrictions in US goods. This uncertainty has already begun to weigh the trust of investors, and companies emphasize strategies in advance of changing global commercial dynamics.

Crypto as coverage against commercial tensions

Historically, periods of geopolitical instability have promoted interest in cryptocurrencies as coverage. Bitcoin and other digital assets, with their decentralized nature and their independence from traditional financial systems, are increasingly seen as safe assets in times of economic uncertainty.

While short -term volatility is expected, the lighter narration suggests an emerging opportunity for cryptography markets. If commercial tensions persist and global economic conditions remain uncertain, cryptocurrencies could benefit from greater demand among investors seeking alternatives to traditional assets.

Desmarization: An accelerated trend?

Trump’s tariff policy could inadvertently accelerate the global impulse towards defolarization. As confidence in US business policies.

Asian economies, in particular, are exploring the use of local currencies and blockchain -based systems to reduce their dollar dependence. China’s advances in Yuan digital infrastructure and Stablecoin regional initiatives can obtain an impulse as nations diversify payment systems to mitigate risks linked to the volatility of the United States policy.

Stablecoins and CBDCS at the Care Center

It is likely that the changing commercial landscape stimulate interest in the stables and digital currencies of the Central Bank (CBDC). These digital assets offer prices stability while allowing cross -border transactions without problems, which makes them attractive alternatives for countries that seek to avoid dollar -based commercial frictions.

In the regions affected by the new rates, Stablecoins could see a greater adoption as companies and individuals seek to protect themselves from the volatility of the exchange rate and commercial interruptions.

What means for global trade

Trump’s tariff climb indicates a possible turning point for international trade and digital finances. For policy, companies and investors formulators, the message is clear: the global trade panorama is changing, and agility will be critical to navigate these changes.

Cryptocurrencies, once seen mainly as speculative assets, can find a new utility as tools for coverage against policy -based market turbulence. As traditional financial systems face increasing pressures, the digital asset ecosystem could play a more central role in facilitating trade and protecting wealth in uncertain times.

Conclusion: A catalyst for change

Trump’s last tariff bombing is not just a headline; It is a catalyst for broader changes in global markets and digital finances. While the immediate effects can be market volatility and diplomatic tension, the longest implications could include a reevaluation of global commercial practices and an acceleration of cryptographic adoption.

Investors and those responsible for formulating policies must closely monitor these developments, recognizing that, although tariffs may be destined to protect internal interests, their domain effects could redefine the dynamics of world trade and financial markets in the coming years.

Writer

@Ellena

Ellena is an experienced cryptographic writer who loves to explore the intersection of blockchain technology and financial markets. She regularly provides information about the latest trends and innovations in the currency space.

See other news and articles on Google News

Discharge of responsibility:

The articles published in Hokanews are intended to provide updated information on various topics, including cryptocurrency and technology news. The content on our site is not intended to be an invitation to buy, sell or invest in any asset. We encourage readers to conduct their own research and evaluation before making an investment or financial decision.

Hokanews is not responsible for any loss or damage that may arise from the use of the information provided on this site. Investment decisions must be based on an exhaustive investigation and advice of qualified financial advisors. Information about Hokanews can change without prior notice, and we do not guarantee the precision or integrity of the published content.